Legal Billing

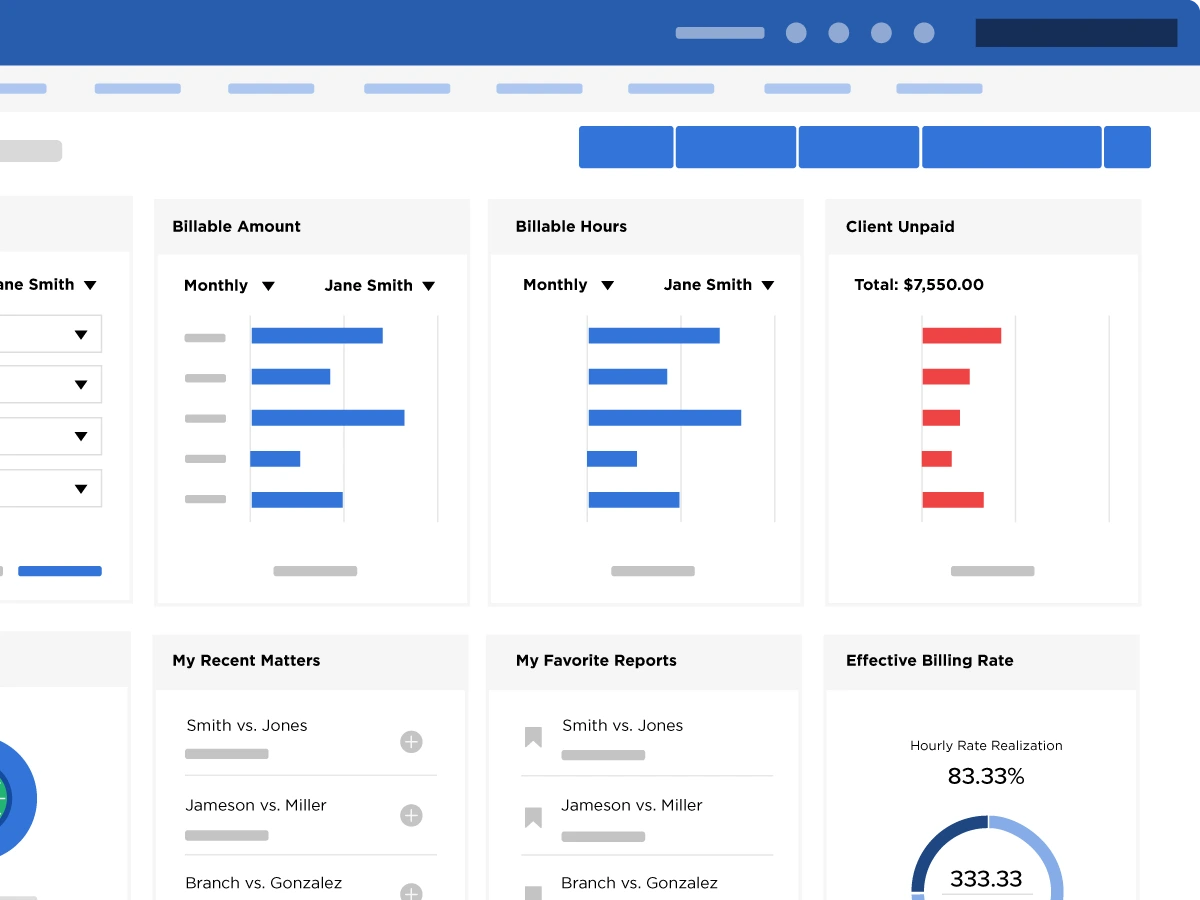

How Many Hours Should an Attorney Bill a Year? Setting Realistic Expectations Fo

How many hours should an attorney bill annually? Realistically, billing expectations shift depending on the firm, p...

The Attorney Billing Cheat Sheet: Nailing Your Billing Narrative

Billing isn’t just about sending invoices—it’s about communicating value. The way you track, describe, and present ...

How Do Attorneys Bill Their Time? Making Every Hour Count

From client meetings to courtroom prep, every minute holds value. But tracking, managing, and maximizing that time ...