How do you keep track of your billable hours? Many lawyers have switched from paper to software, and some have even found time tracking software specifically tailored to the practice of law.

Legal time tracking software is becoming all but essential for today’s attorneys. This is especially true when it comes to billing practices, where many lawyers mistakenly leave money on the table. Even back in 2019, the American Bar Association was citing timekeeping and invoicing as the top two reasons lawyers lose money, and these tasks aren’t getting any easier. How lawyers track their time is often a difference maker for running quick, accurate billing processes that clients can trust.

For any attorney, time tracking software plays a critical role in their success — and choosing the right software matters. But what is the best time keeping app for lawyers to use, and why does it matter which software you pick? And why not just stick with a desk timer? A lawyer’s job is already complicated; won’t software just make it more complicated?

Time tracking software today is not just a digital version of what lawyers did in the past; it’s a virtual assistant that supports the entire billing process, all the way to accepting the client’s last payment. Below, you’ll find more information about what this software does and what features make up the best legal time tracking software for lawyers.

How Do Attorneys Keep Track of Billable Hours Using Software?

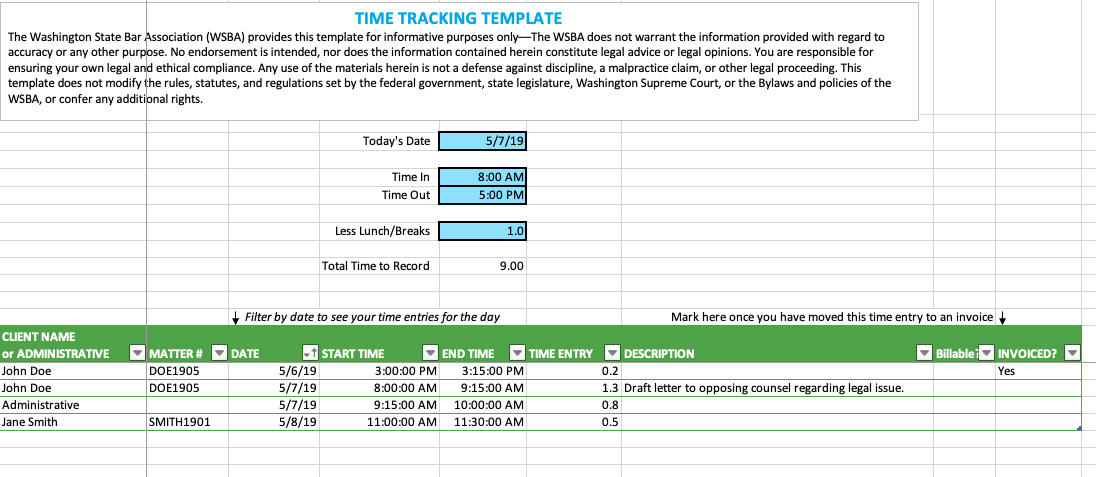

Attorneys using time-tracking software start and stop digital timers for each billable task, with the software automatically recording the time and linking it to the appropriate client or matter. You can also present hourly rates for tasks, allowing the software to categorize billable hours by attorney, case, or other criteria. Switching between tasks is easy as well, as you can pause and resume timers throughout the day, reflecting the realities of a lawyer’s multitasking workflow.

Software like Bill4Time greatly simplifies the repetitive, rote steps of the billing process, particularly when creating invoices. For example, the software automatically translates minutes into decimal increments — like making 9 minutes a 0.2 of an hour — so you don’t have to convert the time to decimals manually.

It also lets you use shortcuts like auto-text, where you set up shortcuts for commonly used phrases. For instance, you could set up ‘disc’ to expand it into ‘Drafted and reviewed discovery responses,’ making it easier to record detailed descriptions without retyping the same phrases repeatedly. Auto-text also encourages continuity in phrasing across your firm’s invoices, making billing descriptions uniform and professional.

What To Look for in Time Tracking Software for Law Firms

Time tracking software should be more than a glorified stopwatch. At its best, this software acts as a support system for your entire billing process. And the most important features for doing that come back to three concepts: security, flexibility, and organization. The best software for time tracking, then, will embody all three of these qualities.

Here are a few common features of high-quality time tracking software that adhere to these qualities:

- Encrypted data storage for confidentiality and compliance with legal standards

- The ability to assign different hourly rates based on the user, client, or matter

- Easy ways to manually edit your past recorded entries

- Options to pause and resume timers for accurate tracking during interruptions

- Built-in tools to generate customizable reports, offering insights into time allocation

- Design fit specifically for use in law firms — for example, LEDES or UTBMS formatting

- Separate tracking for billable and non-billable tasks to give insights into firm operations

- Seamless integration into your billing system for easy invoicing and accepting payment

How Should Lawyers Keep Track of Their Hours Out of the Office?

The best way for lawyers to track their hours out of the office is by using legal time tracking software with a corresponding mobile app. A mobile app ensures that everything you log while on the go syncs with your primary system, so you can pick up right where you left off when you return to your desktop or laptop. This approach eliminates the hassle of manually transferring notes or reconstructing your workday later.

A good mobile app lets you start, stop, and pause timers for specific tasks directly from your phone. For example, if you’re attending an off-site client meeting, you can start a timer as soon as you walk in and stop it when the meeting concludes. Once you’re back at your desk, that entry will already appear in your time log, along with any notes or details you added at the time.

Offline functionality is another feature to consider. In some situations, like visiting a client in a remote area or working in a courtroom with poor cell service, you may not have internet access. A mobile app that works offline lets you log your time and then sync your entries when you reconnect.

Having mobile access to your time records is also wonderful for fostering healthy timekeeping habits. Poor timekeeping habits, such as waiting until the end of the day/week to record billable hours all at once, can cost you as much as 50% of your billable time through guesstimating and forgetting individual tasks you worked on. When you can enter your time right away on a mobile device, you’re more likely to capture all of your billable time accurately.

What Is the Best Invoicing Software for Law Firms Specifically?

While there are a lot of options for time tracking software, most of them don’t cater to the complex nature of billing for a law firm. Legal-specific software must not only account for varying rates but comply with strict ethics and formatting processes. Ideally, the software should also be connected to a firm’s billing and invoicing system, minimizing the steps needed to go from a timesheet to a finished invoice.

Eliminating manual data entry is one of the most important parts of using time tracking software. Rather than transferring data from software to software (or worse, paper to software), it’s best to have an all-in-one, enclosed system for billing. Not only does this save time, it makes for a more secure and accurate billing process.

In addition to the things above, other key features that make for the best software include:

- Invoice templates: Pre-set designs make creating invoices faster, so you don’t have to start from scratch every time. You can even customize them to fit your firm’s brand.

- Client communication portals: These give clients a place to log in, check their bills, and send payments without needing to go back and forth over email or the phone.

- Native e-payment processor: Clients can pay you right through the system, whether they prefer a credit card or an ACH transfer. No extra tools needed.

- Batch invoicing capabilities: If you’re billing multiple clients at once, this feature helps you send out all the invoices in one go instead of doing them one by one.

- Automatic payment reminders: These alerts nudge clients to pay overdue invoices, so you don’t have to spend extra time chasing payments.

How Much Does Legal Time Tracking Software Cost?

Prices for legal time tracking software generally range from $30 to hundreds of dollars per month / per user, depending on the provider. Each software has its own set of features and benefits, so you’ll need to do some comparing and contrasting to find what’s best for you. Keep in mind that price is not necessarily an indicator of function or quality; the best software is not necessarily the most expensive one, and vice versa. That said, you should avoid any free or freemium options — the best legal time tracking software will not be free.

Most legal time tracking software providers will have a tiered subscription plan, with each higher tier providing access to more and more features of the software. For example, Bill4Time offers four tiers of pricing plans depending on user needs.

To illustrate, a solo attorney might prefer a plan that covers basics like tracking hours and creating invoices, while a midsize firm might need additional features like customizable fields or advanced reporting. Larger firms might prioritize options for batch invoicing or compliance-friendly billing formats like LEDES. The best plan will always depend on the size of your practice and the specific tools you rely on daily.

What Is the Best Free Legal Time Tracking Software?

Unfortunately, a free time tracking app for lawyers is almost certainly not going to be worth your time or effort to use. Attorney time tracking requires high-functioning software that’s secure, well-designed, and tailored specifically to the needs of the legal industry. And no software is going to provide any of these traits for free, much less all three of them. They certainly won’t provide much in the way of customer support (if at all), which is more or less critical to ensure you make the most of using the software.

Even if free software does offer some use for attorneys, it’s most likely going to be a “freemium” version of the provider’s software, which is typically designed to frustrate you into paying for the software. The freemium version will limit your usage — either by blocking essential features, limiting data storage, or removing security measures that are required to maintain compliance. Many free options will ultimately require pairing with other software to make them work at all, which defeats the purpose of not paying for software in the first place.

You should expect to pay for legal time tracking software. But you should also expect to make that money back, and much more, in the time and effort you save for your billing process. Paying for this software is not an expense, but an investment — one that’s well worth making if you want to run a successful, efficient, ethical practice.

Practice More And Manage Less With Bill4Time

An efficient, streamlined process for billing can make all the difference in running a successful practice — and with the right software, that’s more than achievable.

Bill4Time not only offers the best in time tracking but also a complete practice management solution. Keeping your billing and case management in one system means your time entries and case details are always connected, making it much easier to create accurate invoices. There’s no need to transfer data between programs, which reduces the chances of mistakes and saves time. And thanks to Bill4Time’s native payment processor, collecting payments can be just as easy and secure, for both you and your clients.

Ready to spend less time billing and more time practicing law? Check out Bill4Time today with a free trial, or click the button below to schedule a free demo. Once you see how Bill4Time works, you’re going to want it in your firm — and we’ll be there to help every step of the way!