The concept of billable hours versus actual hours plays a pivotal role in defining both the economic health and operational efficiency of law firms.

Billable hours are the hours law firms charge their clients for, directly affecting their revenue. Conversely, actual hours encompass all work done by lawyers and staff, including non-billable tasks such as administrative duties and client relations.

Understanding the balance between these two types of hours is essential for legal professionals when evaluating career growth, assessing firm stability, or looking to improve workplace efficiency.

Effective management of these hours is key, and many legal professionals leverage technology to keep accurate records and analyze their work distribution. Legal time tracking software, for instance, can simplify this process, helping attorneys identify areas where they can optimize their billable hours while ensuring they maintain a balanced workload.

As we further explore the nuances of legal billing, upcoming sections will cover topics like:

- What are billable hours vs. actual hours, exactly?

- How do I define billable and non-billable hours?

- What are some examples of non-billable hours and billable hours?

- What’s the best way to calculate a billable hour when tracking my time?

- What should my billable rate be in relation to my salary?

- How can I get my billable hours up?

We’ll break down these elements, offering actionable insights to enhance your practice’s efficiency and profitability.

What Is the Difference Between Billable Hours vs. Actual Hours?

Billable hours are the hours that you can charge to a client. These are directly tied to revenue and usually include time spent on tasks like research, drafting documents, and court appearances that directly advance a client’s case. Because your clients pay for billable hours, it’s essential that your firm properly tracks them to keep profits up.

Actual hours include all the time you work, not just what you can bill. This broader category encompasses billable tasks plus additional non-billable activities (more on billable vs. non-billable hours in the next section). For example, if you spend 10 hours working one day, you will likely only spend a portion of that time on tasks you can bill to a client.

When considering the realities of working in a law firm, it’s important to understand how much of your time you can realistically bill to clients. Non-billable time isn’t wasted — these activities are essential for running a successful practice and developing your skills as a lawyer. However, they do not generate direct revenue, and managing the balance between billable and actual hours is a critical skill in legal practice management.

Non-Billable Meaning vs. Billable Meaning

Within your actual hours will be billable and non-billable hours. Non-billable hours are time spent on tasks necessary for your practice but not chargeable to any client.

Attorneys determine their billable hours and fee structures primarily based on ethical standards outlined by the American Bar Association (ABA) and state-specific rules.

For example, many attorneys would look to the ABA’s Model Rules of Professional Conduct Rule 1.5 for initial guidance:

- Lawyers are prohibited from charging or collecting unreasonable fees.

- In assessing the fairness of a fee, considerations include the customary charges in the locality for similar legal services, the amount of time required, and the lawyer’s experience, among other factors.

- Lawyers must disclose their fee structure to clients early in the client-attorney relationship to prevent misunderstandings.

And then they look at any state-specific rules, like these two examples:

- California’s Rule 1.5 includes a rule that states, “Unconscionability of a fee shall be determined on the basis of all the facts and circumstances existing at the time the agreement is entered into except where the parties contemplate that the fee will be affected by later events.“

- Texas’s Rule 1.04 gets specific with this rule: “A lawyer shall not enter into an arrangement for, charge, or collect a contingent fee for representing a defendant in a criminal case.”

These rules are set to ensure transparency, fairness, and ethical billing practices among law firms across the U.S.

Still, it can be tricky to determine billable vs. non-billable hours. While the differences and billable hour requirements by firm may differ, we’ll discuss what you can generally bill for below.

What Counts as Billable Hours?

Billable hours include the time legal professionals dedicate directly to handling client matters. While the scope of what can be considered billable varies across firms, the following tasks are generally billable:

- Initial Consultations: Meeting with a prospective client to discuss their case.

- Document Preparation: Drafting legal documents, contracts, briefs, and pleadings.

- Document Review: Analyzing and revising legal documents received from opposing parties.

- Legal Research: Investigating case-relevant laws, precedents, and regulations.

- Case Strategy Development: Crafting strategies for case management and litigation.

- Client Communications: Exchanging information with clients via emails, calls, or meetings.

- Court Appearances: Attending trials, hearings, and other court proceedings.

- Mediation and Arbitration: Representing clients in alternative dispute resolutions.

- Depositions: Preparing for and conducting depositions.

- Settlement Negotiations: Discussing and negotiating settlement terms.

- Trial Preparation: Organizing case materials and strategies for trial.

- Witness Preparation: Coaching witnesses for depositions or trial testimony.

What Is an Example of a Non-Billable Hour?

A non-billable hour refers to time spent on activities that support the operations or development of a law firm but cannot be directly charged to a client. Some examples of non-billable hours include:

- Internal Meetings: Time spent in staff meetings that don’t directly involve client cases.

- Clerical Work: Organizing files, photocopying, and other clerical duties not specific to a client’s case.

- Training Sessions: Attending in-house training or continuing legal education (CLE) courses.

- Business Development: Engaging in networking events or marketing activities to attract new clients.

- Mentoring: Time spent mentoring junior staff or interns without direct client involvement.

- Pro Bono Work: Providing legal services voluntarily without charging a client.

- Researching Legal Software: Looking into new technology for your law firm that is not client-specific.

- Reading Industry Publications: Keeping up-to-date with legal journals and news that are not case-specific.

- Preparing Invoices: Compiling billing information and preparing client invoices.

- Website Maintenance: Updating the firm’s online presence, including blogs and social media, without direct client service.

- Staff Recruitment: Time spent interviewing potential new hires or reviewing resumes.

- Performance Reviews: Conducting or participating in performance evaluation meetings.

How Do You Calculate a Billable Hour?

To calculate a billable hour, you record the time devoted to direct client services and then apply your hourly rate to that time. There are a few steps involved in calculating your billable hours, such as:

Having a Billable Hours Chart Handy

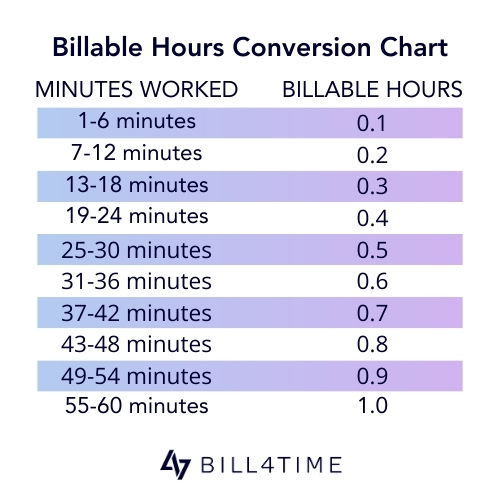

If you bill in the standard 6-minute increments, using a billable hours conversion chart like the one below is quite helpful. These charts break down minutes into tenths of an hour, so you can easily convert time to a decimal. Eventually, converting your time will become second nature.

For example, if you worked 14 minutes on a task, you can see on the chart below that that converts to 0.3 hours.

Tracking Your Time

Tracking time accurately is crucial for ensuring proper billing. Here are several methods that attorneys might consider:

- Digital Tracking: Using attorney time tracking software is highly effective and reduces errors.

- Manual Logging: Daily logging of tasks on a calendar or in a digital document like Excel or Google Sheets can serve as an alternative, though it’s less efficient.

- Communications Review: Periodically reviewing emails and call histories can help reconstruct time spent on client-related activities, although you can miss hours with this method.

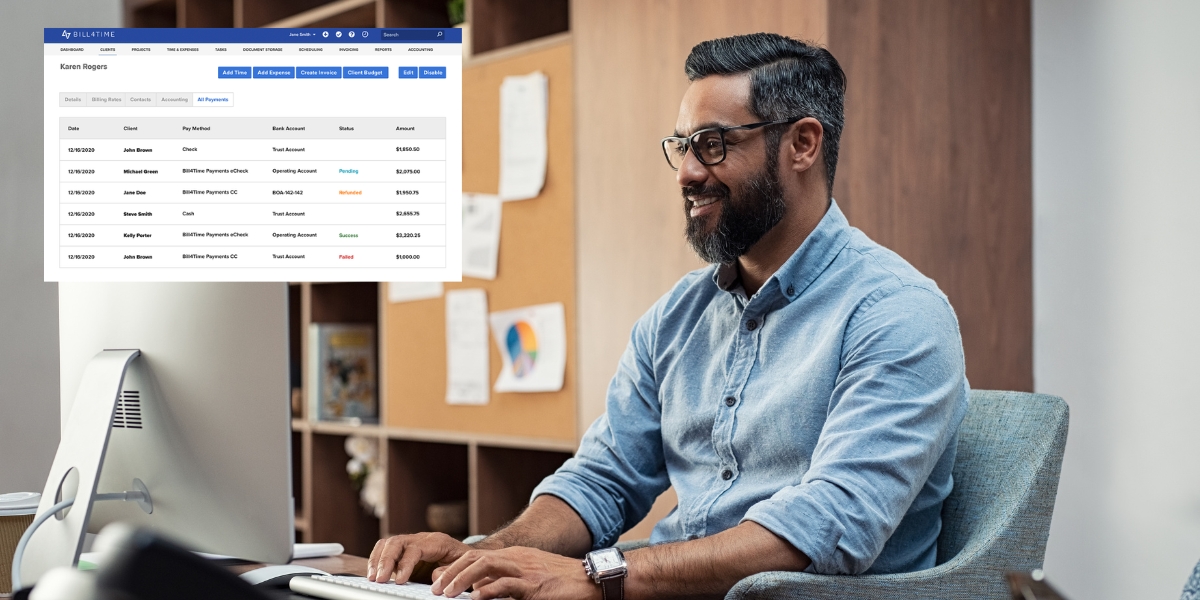

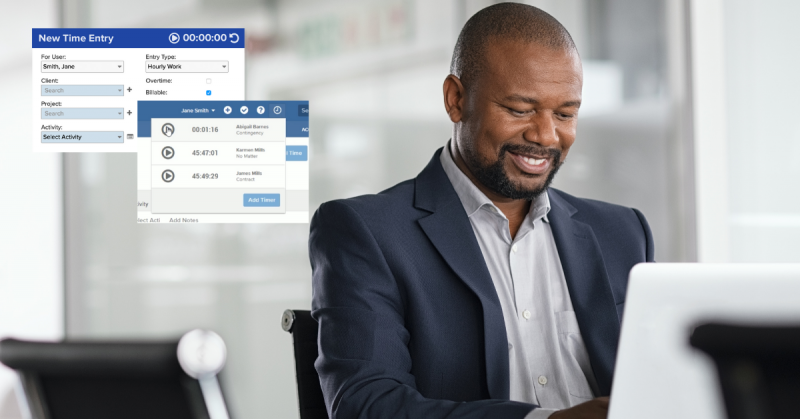

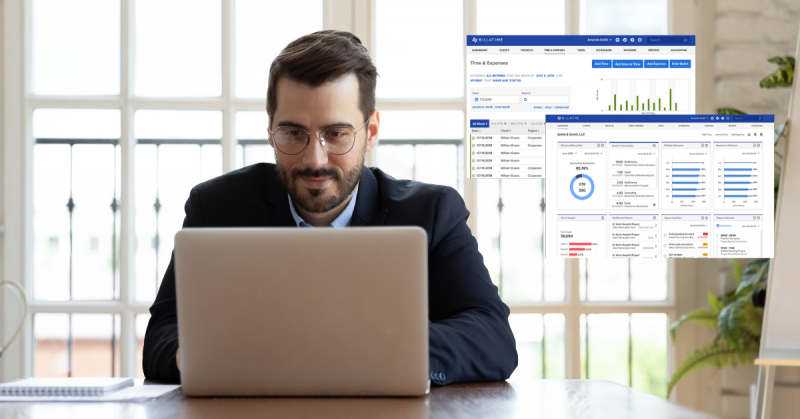

Tracking your time with legal software is usually your best bet for capturing every billable moment. Bill4Time, for example, allows attorneys to track their time as they work with handy on-screen timers or enter their time manually after a task is complete.

Rounding Up

Attorneys often round up to the nearest allowable increment to ensure they are compensated for the total time spent on a task. For example, if a task takes 43 minutes, rounding up to the nearest tenth of an hour (0.8) is common practice rather than billing for 0.7 hours.

Multiplying by Your Billing Rate

Finally, multiplying the rounded decimal hours by your hourly rate determines the fee. For instance, if the billing rate is $300 per hour and the task duration is 48 minutes (0.8 hours), you would multiply $300 by 0.8 for a total of $240 earned.

While manually calculating your billable hours is possible, it’s time-consuming and can be inaccurate. It’s even worse when you try to do it from memory at the end of a long week. Alex Dimitrief, a prominent trial lawyer with extensive big law experience, emphasizes the pitfalls of delayed time tracking:

“Lawyers who catch up on time at the end of a billing period with vaguely-worded guesstimates are also not doing right by their colleagues. The belated recording of stock time entries often results in billing for less time than a lawyer actually worked and prevents the firm from gaining meaningful insights from its data.”

Using software like Bill4Time can help you avoid these pitfalls. Bill4Time’s robust time tracking features are designed to meet the unique needs of legal professionals, ensuring no billable minute is overlooked. You can see exactly how it works with a free trial.

How Much of Your Billable Rate Should Be Your Salary?

Determining your billable rate and salary involves a careful balance between understanding your costs, the value you provide, where you are located, and your practice’s financial goals. Let’s walk through this process step-by-step.

Step 1: Identify and Add Up Your Overhead Costs

Start by listing all your operational expenses. Below are some typical overhead expenses an attorney may incur with some hypothetical costs per month:

- Office rent – $2,500

- Utilities (electricity, water, internet) – $400

- Administrative and support staff salaries – $5,000

- Legal research subscriptions – $250

- Professional liability insurance – $80

- Continuing legal education (CLE) fees – $50

- Marketing and advertising expenses – $500

- Office supplies and equipment – $200

- Technology costs (computers, legal software subscriptions) – $250

- Travel expenses related to client meetings or court appearances – $170

Adding these expenses together, your total monthly overhead would be approximately $9,400.

Step 2: Analyze Market Rates and Define Your Competitive Edge

Understanding the market rates charged by peers in your legal specialty and geographical area is critical. This insight helps you set a competitive rate that reflects your unique qualifications and experience. You can gather this information by:

- Consulting professional associations and networks. Many legal professional associations, like local bar associations, conduct and publish annual surveys detailing average billing rates across various specialties and regions.

- Using online legal services platforms. Platforms such as Martindale-Hubbell, Avvo, and LegalMatch allow you to view profiles of other attorneys in your area, including their specialties, client reviews, and sometimes even their billing rates.

- Attending industry conferences and seminars. These gatherings are excellent for learning about the latest trends and challenges in your field of practice.

- Conducting informal peer consultations. Reach out to colleagues and mentors to discuss their experiences with billing.

- Analyzing competitor marketing and client engagement strategies. Pay attention to their online presence, including websites and social media. This data can tell you a lot about their target clients, the complexity of cases they handle, and their market positioning.

For instance, if you discover that most attorneys in your city with similar skills charge between $300 and $450 per hour, and you possess specialized knowledge or certifications, you could set your rate closer to $450. This higher rate reflects the additional value you bring to clients.

Step 3: Factor in Your Qualifications and Experience

Your experience, reputation, and area of specialization are significant determinants of your billable rate. For instance, if you are a lawyer with over ten years of experience in corporate law with a track record of high-profile case wins, your rate should reflect this.

Consider also your operational efficiency and client satisfaction levels, which can command a premium in your billing. Your rate should cover costs and signal your market position as a top-tier attorney.

Step 4: Set Financial Goals and Calculate Your Desired Salary

Decide on a target annual income based on your personal financial goals, professional growth aspirations, and market standards.

For example, if aiming for a salary of $150,000 a year is aligned with your expertise and years of practice, calculate your required billable rate by adding your overhead costs and a profit margin to your salary needs. Here’s how to do so:

- Determine Your Annual Overhead: If your monthly expenses are $9,400, your annual overhead costs would be $9,400 x 12 = $112,800.

- Set Your Annual Salary Goal: You’ve decided on a target salary of $150,000 per year.

- Include Desired Profit Margin: You want a 25% profit margin on top of your combined salary and overhead costs. First, add your salary and overhead: $150,000 (salary) + $112,800 (overhead) = $262,800. Next, calculate 25% of this amount for the profit margin: 25% of $262,800 = $65,700.

- Calculate Total Needs: Add your profit margin to the sum of your salary and overhead to get the total amount you need to generate: $262,800 + $65,700 = $328,500.

- Determine Billable Hours: You may ask yourself, is 1,800 billable hours a lot? Consider that you’ll need some downtime, and managing a strong work-life balance is important to your success. If you have to wonder how many billable hours are too much, you may be overworking yourself. The National Association for Law Placement (NALP) also reports on average billable hours for lawyers, which you can check for a good starting point. For this example, let’s say you plan to bill 1,500 hours a year (approximately 30 billable hours per week).

- Calculate Your Billable Rate: Divide your total financial needs by your billable hours to determine your hourly rate: $328,500 / 1,500 hours = approximately $219 per hour.

In this example, charging at least $219 per hour will cover your salary, overhead, and desired profit margin.

Step 5: Regularly Review Your Pricing Strategy

The legal market and your practice needs will evolve, so you will need to regularly review your billing structure. Stay up-to-date on changes in market demand, legal technology advancements, and your own practice’s growth or specialization changes.

Annual or bi-annual reviews can help adjust your rates to remain competitive and profitable, ensuring they accurately reflect your current practice status and market conditions.

How To Increase Billable Hours

One proven strategy for boosting billable hours without reducing service quality is using legal software like Bill4Time. You can see how it works for yourself with a free trial.

Traditional time tracking methods — using spreadsheets or written logs — often lead to lost hours, inaccuracies, and valuable time spent on non-billable tasks. Plus, trying to reconstruct days or weeks of activities at the end of a billing period can result in underreporting, affecting both revenue and insight into work patterns.

Bill4Time addresses these challenges with real-time tracking that captures every minute as it happens, eliminating the inaccuracies associated with delayed logging. Its intuitive interface works on multiple devices, ensuring accurate tracking both in and out of the office.

Bill4Time also generates detailed reports that highlight time spent patterns, providing strategic insights into managing tasks and billable objectives. For example, excessive hours spent on research might indicate the need to delegate preliminary research tasks to paralegals or junior staff.

Finally, integrating Bill4Time into your practice supports not just individual lawyers but entire teams. It streamlines case management processes, enhances transparency with clients through clear and detailed invoices, and supports compliance with the stringent ethical standards required in legal billing.

Want to see how Bill4Time could very well be your next step toward a more profitable and efficient practice? Get started with a free trial today!