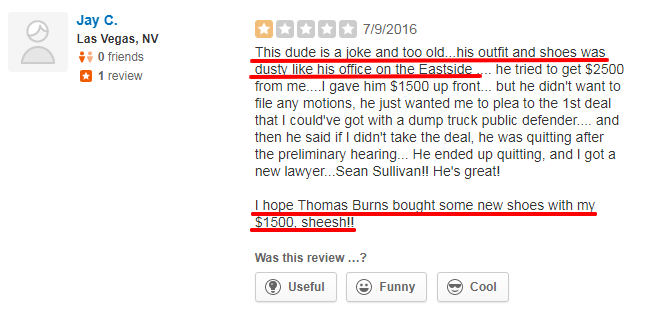

There’s so much lawyers can automate, yet they believe automation is risky.

That’s the hidden fear many attorneys have. There’s a fear that automation won’t work consistently or that devastating mistakes will be made.

Are these fears unfounded?

Absolutely. In the ultimate guide to automation, I shared the strategies and tactics top performers use to automate their legal practice. These strategies include important checks and balances that allow you to verify tasks are performed as expected.

What about the tasks you can’t automate?

You know, the ones that require people?

There are a variety of tasks attorneys and their support teams perform on a daily basis that can be automated. Often times, the immediate assumption is that “automation” = AI. But AI isn’t a must-have for automation.

More often than not there’s a mix.

Typically it’s a combination of people, technology and information. This is a key point as many seem to feel it’s not truly automation if people are involved.

Why is this the case?

The paradox of automation.

In his book The Personal MBA, Josh Kaufmann talks about the paradox of automation. He outlines a surprising twist to the coming automation/AI revolution.

“The paradox of automation says that the more efficient the automated system, the more crucial the human contribution of the operators. Humans are less involved, but their involvement becomes more critical.

If an automated system has an error, it will multiply that error until it’s fixed or shut down. This is where human operators come in.”

Did you catch that?

The more efficient the automated system the more important you are to that system. This has far-reaching applications for you and your firm. This applies to every industry across the board.

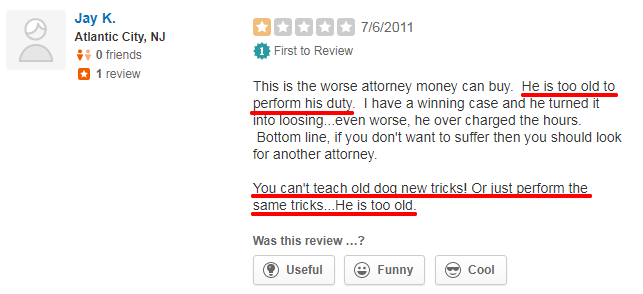

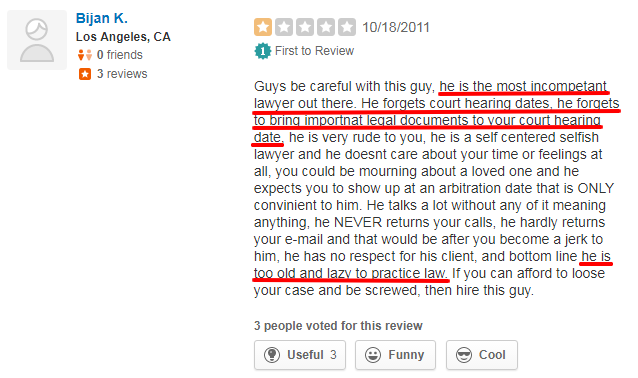

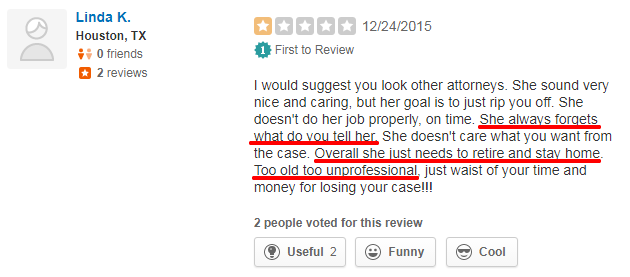

Attorneys without automation are in danger

You’re being squeezed.

Crushed by the growing demands around you. Clients are demanding more value for less money. Firms are expecting more billables. All across the country, hourly rates are going up as revenue and profit declines.

You’re expected to do much more, with much less.

Attorneys that neglect automation are in danger of being left behind by their peers. Attorneys who can keep up with new demands from their clients, partners and peers will win.

There’s only one way to keep up.

Automation.

Here are three unexpected tasks attorneys can automate to maximize billables, improve performance and decrease work times.

Task #1: Legal research and monitoring

Wouldn’t it be great if you could feed your memorandum or brief to an AI and receive a list of relevant cases back in return? Instead of spending hours on Lexis wouldn’t it be nice to have relevant results sent to you?

Apparently, you can.

Tools like Ross Intelligence and Eva provide attorneys with the on-demand legal research they need. You ask legal questions in plain English and you get automatic answers to your questions. Data in all practice areas. Data from State and Federal courts, published and unpublished.

Take a look.

Analyze briefs, memos, motions, and pleadings. Monitor developments in law around the clock, receive automatic notifications. Ross isn’t the only option either. Attorney IO, Casetext’s CARA and Judicata are all good options.

It’s not mainstream yet.

And most attorneys aren’t all that familiar with AI powered research, how it works or what the true potential is.

Task #2: Legal analytics

Legal analytics gives you an unfair advantage. Imagine being able to:

- Identify the likely outcome of your case

- Determine how good opposing Counsel really is ahead of time

- Use hidden data to optimize every litigation decision

- Gather intelligence on opposing Counsel, mapping their strengths and weaknesses

- Identify the most efficient and effective attorneys in front of a particular judge

- Optimize your law firm’s performance, compared against your top performing competitors

- Identify corporate clients with significant trouble spots you can fix

- Accurately assess the effectiveness and persuasiveness of your expert witnesses

This is just the tip of the iceberg.

Take a look.

Legal analytics uses machine learning, data mining and natural language processing to uncover unknowable insights. Insights into people, firms, and organizations. It provides you with the must-have data your firm needs to grow. The data you need to establish a strong competitive advantage.

Legal analytics = Moneyball for lawyers.

It’s a way for you to rapidly learn from the success and failures of firms around you. It’s not a replacement for attorneys and good ole’ fashioned legal work, it’s a turbocharged supplement. And the best part?

Most attorneys are not on board. Yet.

Task #3: Contract and document analytics

Contract review is tedious and time consuming.

It can be difficult to extract data (e.g. effective/termination dates, interest rates, etc.). Locating key clauses (e.g. assignment restrictions or termination clauses) isn’t always as simple and as straightforward as you’d like it to be.

Contract analytics automates the process.

This is key.

Clients aren’t as open to the idea of paying for extensive research and reviews anymore. The pressure is on. You’re expected to provide value, not ring the meter. Contract analytics saves precious time and resources.

Luminance, LegalSifter, iCertis, eBrevia, and ContraXSuite are notable options.

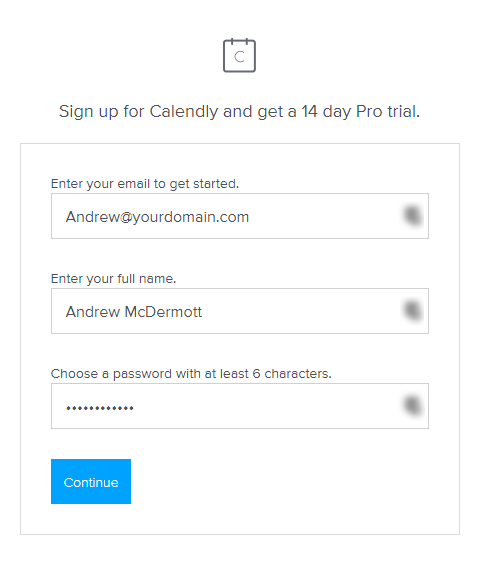

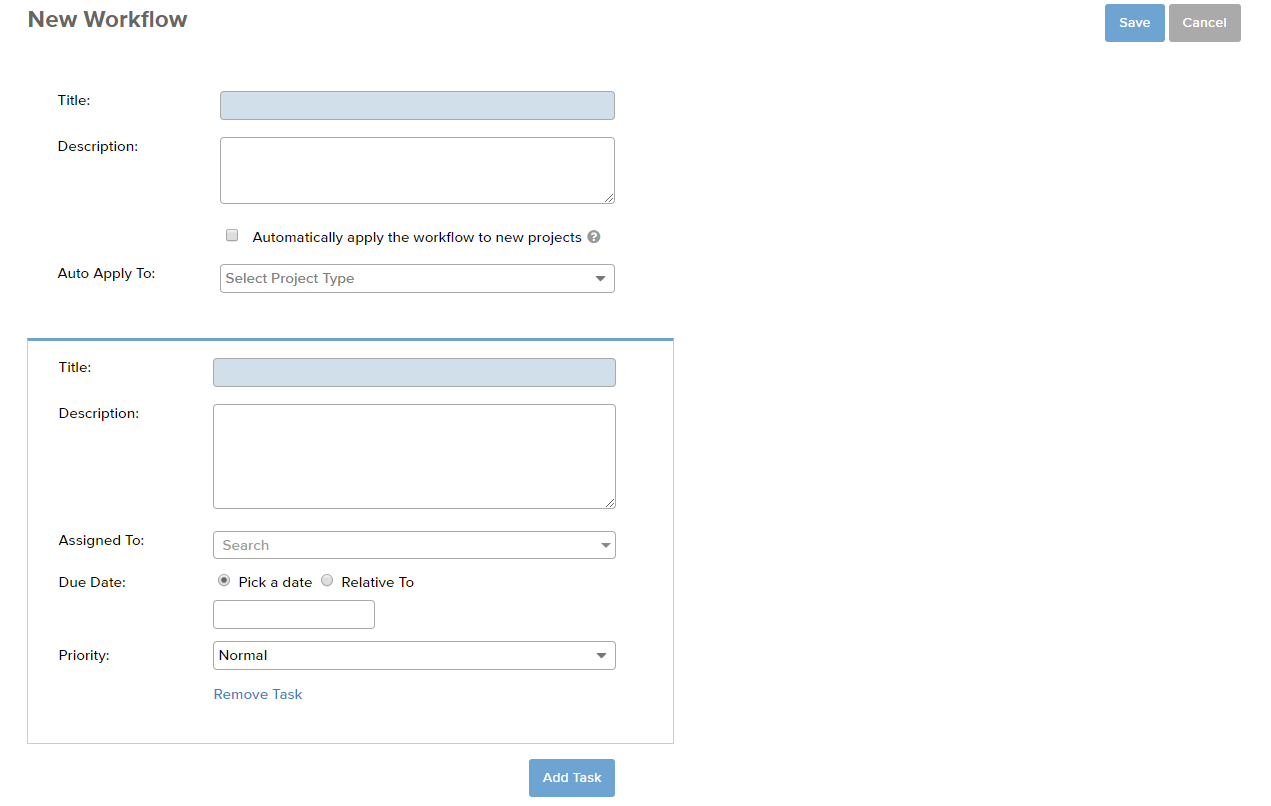

Task #4: Virtual receptionists

At some point, your clients will want to talk to you.

This isn’t always as productive as it should be. Virtual receptionists can be available 24/7. They’ll answer incoming calls, schedule appointments and relay messages to clients. They’ll follow up with clients who haven’t paid their bills and handle the human side of new client intake.

Imagine never having to chase your clients again.

These services are lifesavers for the solo, small and medium firms that are looking to scale. Notable services include:

Automation isn’t risky, it’s indispensable

AI won’t replace attorneys, it makes them more valuable. Thanks to the paradox of automation you’re the most important piece of this automation puzzle. Automation isn’t a risk as long as you’re involved in the process.

Mismanage your work and the risk goes up.

Use the right checks and balances to protect your business and your productivity will skyrocket. Top performers in your industry are already using these strategies and tactics to outperform and outmaneuver their competitors.

Now, it’s your turn.