The legal invoice process can be a headache for many law firms. From managing different accounts and payment deadlines to ensuring the time tracking is accurate and the invoice reflects different fee structures, it is difficult to imagine a frictionless version of this workflow. Thankfully, automated legal billing software has made this process seamless for all-sized law firms.

This blog post will further explain how to create a custom legal invoice template and the benefits for your firm.

How Do Lawyers Track Their Time?

The ways legal professionals track the time spent on a case have evolved over the years. Traditional practices included:

- Filling tasks and time entries directly in their calendar;

- Cross-checking the time-stamp of a sent email;

- Monitoring the time spent working on a document;

- Tracking the history of phone calls;

- Excel sheets listing their daily activities;

- Or simply writing down by memory how they spent their time throughout the day or week.

Though traditional, these strategies have hidden flaws. Besides being inefficient and time-consuming, the human aspect leaves room for error. Today, there are several legal billing software, such as Bill4Time, with time tracking features and additional functionalities that have widespread benefits for firms.

By using a legal time tracking software like Bill4Time, a lawyer’s hourly rate can be broken down into specific billable slots that can be easily justified on behalf of the client. Automated time tracking also saves time trying to record hours and allows for greater accuracy as a few minutes of responding to an email can be easily captured.

When Does a Lawyer Bill for Their Services?

Lawyers will generally invoice a client once a month during representation or when their representation is complete. This can vary based on the practice area and the nature of the service.

For example, in matters involving litigation, attorneys might bill for services at specific stages, such as after the initial pleadings, following major motions, or at the conclusion of a trial. Each of these stages represents a significant amount of work, and billing at these intervals helps manage the financial expectations of both the lawyer and the client.

Some attorneys may offer alternative billing arrangements to meet client needs. These can include flat fees for particular services, retainer agreements for ongoing matters, or contingency fees, where the lawyer’s payment is a percentage of the client’s winnings in a case.

Communicating the billing timeline and policy to a client upfront is essential to mitigating common billing mistakes and unhappy clients. Plus, no one likes receiving an unexpected hefty bill.

How To Create a Custom Legal Invoice Template

Law firms have unique yet complex billing needs. To address this reality, legal invoicing software has emerged across the market. These resources are an indispensable piece of any firm’s tech stack as they address the complex nature of legal billing.

Bill4Time comes equipped with features to manage all aspects of the invoicing process. The platform allows you to create custom invoice templates that can be stored for repeated use.

Invoice templates reduce administrative work as your details, hourly rates, client information, and payment method are included in the invoice. You can also customize the invoice templates to your firm’s brand. Lastly, they can also be used to automate recurring invoices, all while keeping the process professional and organized.

What Is Included in a Legal Invoice Template?

There are a few common items that are always included in a legal invoice template:

- Contact information: Both the law firm and the client’s contact information should be clearly listed in the heading of the invoice. This includes the company name, their point of contact’s first name and last name, a phone number, an email, and an address.

- Send date: The date on which the invoice was created and sent should be indicated for accounting purposes, but also to keep in account the payment terms. For example, if the payment is due 30 days after receiving the invoice, the date indication will help better identify the deadline.

- Payment terms: The conditions and expectations around the payment should be identified on the invoice.

- Hours billed: The total sum owed should be broken down to include the number of hours billed for the services provided.

- Line items with the service date and associated cost: Details on the services provided should be indicated to provide clarity.

- Subtotal: The invoice should include the total sum of the different services and taxes if applicable.

- Due date: To ensure the payment is received within a reasonable delay, the due date should be indicated on the invoice.

Best Practices for Sending a Legal Invoice

Having a client-focused approach to your firm’s practice applies across all client interactions. From their initial intake to the payment, having a good reputation and repeated business requires clients to feel understood and appreciated throughout their interactions. A pleasant invoicing experience can be an opportunity to distinguish yourself from competitors.

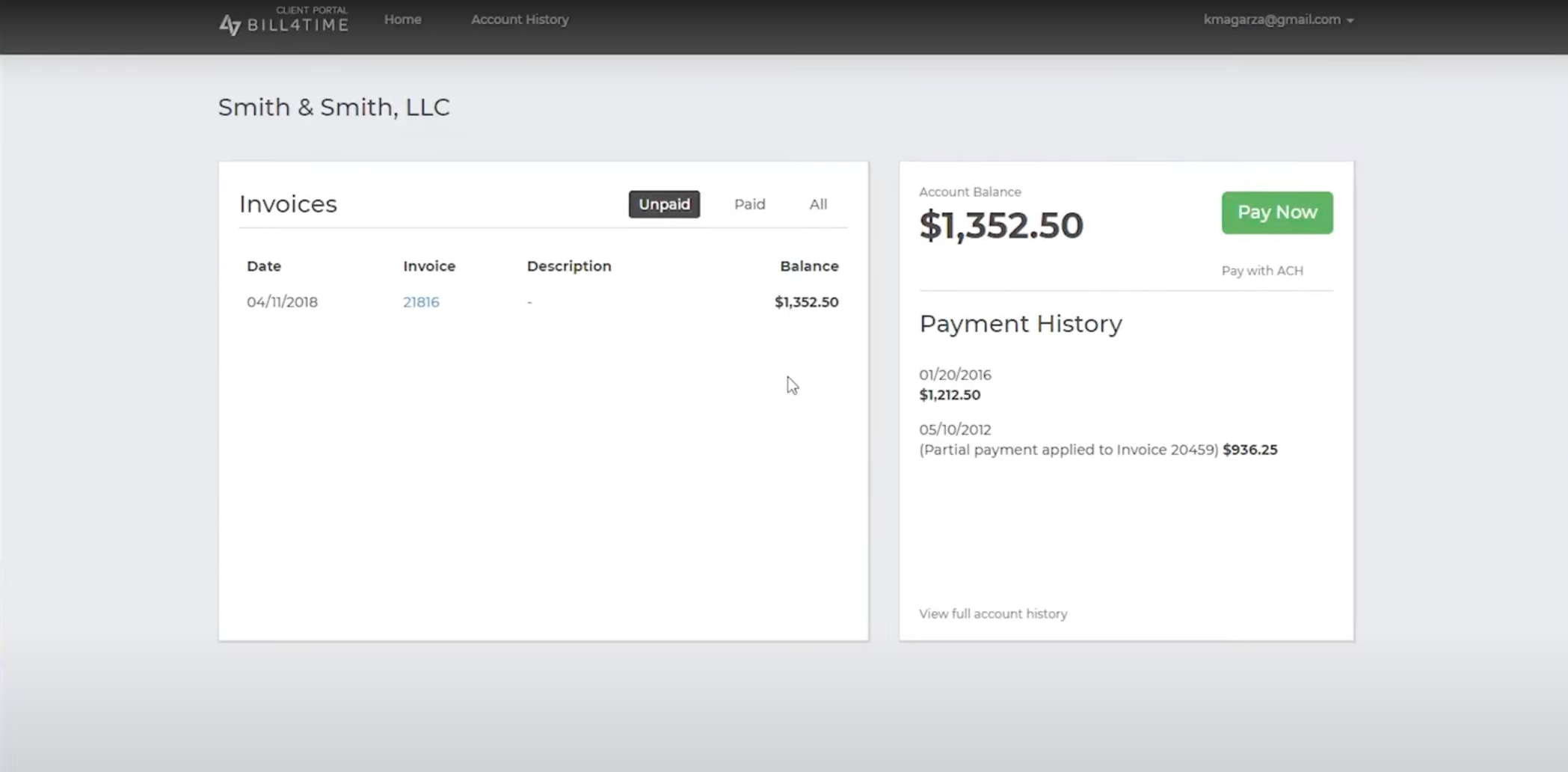

Before sending an invoice, ask your client who the invoice should be made out to and if they have a preferred payment method — does the client prefer receiving an invoice via email or instead going through the client portal? Do they want to pay by credit card online or by check? These are all factors to consider before sending the invoice.

How To Get Clients To Pay Their Legal Invoice

Running after a client for an unpaid invoice is never enjoyable. Below are some actionable steps to help mitigate the likelihood of late or unpaid invoices.

1. Clearly Communicate Your Billing Policy

The initial client intake consultation is the perfect opportunity to clearly communicate expectations around billing and payments. This information should be provided transparently during the first meeting and written in the onboarding documents.

2. Invoice Your Clients On-Time

The best way to consistently send invoices on time is to set automated reminders. Creating a system of reminders where clients receive their monthly statements three to four days after the beginning of the month can help increase the likelihood of timely payments. Most people set their payroll toward the start of the month, meaning your client invoice would be paid after processing employee payroll. Moreover, having a set schedule crystallizes expectations and minimizes the time between completing and billing for the work.

3. Offer an Online Payments Option

Every invoice should be clear, concise, and have a simple payment system. To avoid the time-consuming practice of processing paper checks, offer an online payment option to your clients. Through Bill4Time’s built-in payment processor, Bill4Time Payments, you can accept and process online payments right within the platform. You can also create custom payment links to add to your website or even your emails.

Simply adding this in-demand payment method can get your law firm paid 70% faster than average billing practices.

Tracking Your Legal Billing and Invoicing

By using automated legal billing software, you get access to comprehensive reporting to view your firm’s financial performance. Data within this dashboard includes accounting activity, the historical activity of accounts, expenses, month-by-month productivity, and user activity.

With Bill4Time’s exclusive reporting, the types of expenses and time reports can include:

- Account Activity Report: A general accounting report that reflects payments made from the Trust account to the operating account.

- Account Balance Report: An accounting report with the balance due for each matter.

- Billable Utilization Report: A report outlining targets vs. what was actually billed.

- Client List Report: A report showing various client details.

- Collections Report: A payments report showing the amount collected for each invoice.

- Inactivity Report: A report showing how long since a matter has been worked on.

- Invoice A/R Aging Report: A standard accounts receivable aging report.

- Invoice Email Report: A history of invoices report.

- Invoice Status Report: A report listing the payments that need to be applied to invoices.

- Realization Report: A report of the amount billed/finalized divided by the total hours.

- Resource Utilization Report: A report with the Performance Targets in the User Profile vs. Labor Hours.

By identifying and viewing this data, you can identify trends to achieve success and get insight into the forecasted revenue.

Implement a Custom Legal Invoice Template Process

With minimal upfront work, your law firm can create a legal billing and invoice process that saves you time and money down the road. Bill4Time offers all of the features your firm needs to eliminate time-tracking errors, streamline your billing, automate your invoices, and process online payments.

If you’re ready to optimize your firm’s time tracking and legal billing process, you can schedule a demo of Bill4Time or start a free trial to see the multiple timers or online payments functionality in action.