6 Firm Wide Metrics to Evaluate and Improve Your Practice

08/15/2018 By Bill4Time Staff

Is your law firm doing well?

How do you really know that your firm is doing well? When it comes to firm wide metrics, many aren’t sure they have the answer. Their gut feeling tells them all is well so they go with that.

Maybe they’re right?

Or maybe their assessment of their firm is completely wrong. Is there a way to objectively find the right answer?

Absolutely.

Want objective proof? You need firm wide metrics

You gain clarity with the right metrics.

These metrics give you hard data on your firm’s performance. There’s no guesswork involved, no indecision on what needs to be done. Just crystal clear, actionable evidence to follow. With the right metrics you know (a.) when you’re off course (b.) what needs to be corrected and (c.) when you’re back on track.

Why does that matter?

These metrics enable you to avoid “decision by committee.” There’s no need for partners and shareholders to debate the merits of what can work. These metrics show you what will work.

Which metrics are we talking about here?

- Cost per client conversion / acquisition

- Cost of servicing a client

- Realization

- Profitability

- Individual performance

- Satisfaction (clients and employees)

1. Cost per client conversion / acquisition

How much does it cost to acquire a client? Which platform sends you the most clients? Which platform sends you the best clients? The cost per conversion / acquisition metric is a fantastic way to get data-driven answers to these questions.

Cost per conversion

Most attorneys know what I mean by conversion.

But, for the sake of clarity, I’m going to define it here. A conversion occurs when a prospect completes the desired goal. Calling you on the phone, sending you an email, filling out a contact form on your website, etc. It’s a goal or outcome that leads to revenue.

Easy.

Here’s the formula to calculate your cost per conversion.

Cost of traffic / by the number of conversions = Cost per conversion

If you have goals set up in Google or Adobe analytics, you’ll have what you need to track your cost per conversion and cost per acquisition.

Here’s why this matters

You’ll be able to get detailed data on:

- The marketing channels that work best for your firm (e.g. Google AdWords, Facebook Ads, display advertising, guest posts, etc.).

- Which website, landing pages, offers or ads produce the greatest amount of conversions you want

- A keen minute-by-minute awareness of your marketing effectiveness

It’s a helpful way to measure your marketing effectiveness – without delving too deeply into data science and complex formulas.

Cost per acquisition

Here’s the formula to calculate your cost per client acquisition

Marketing expenses / number of clients = Cost per acquisition (per client)

Here’s the thing with this formula. You’ll need to be consistent with your timeframe. If you spent $2,000 on marketing in a month and you acquired 20 clients in that same month, your cost per acquisition would be $100 per client.

Here’s why this matters

If you have a set breakeven point this metric shows you whether you’re on track (or not). Let’s say your breakeven point for a specific practice area (e.g. bankruptcy matters) was $530 per client. If you spent any more than $530 to acquire a bankruptcy client you’d lose money. Anything less than $530 and you’re making money.

Here’s an important caveat.

Your breakeven cost per acquisition may vary by practice area. This is important. It enables you to allocate your marketing dollars to practice areas with the greatest financial upside.

Your breakeven point is your initial target.

2. Cost of servicing a client

This takes our previous point further. Calculating the cost of servicing a client requires that we factor in all of our fixed costs. We need to determine what it takes to attract and win a new revenue producing client.

Fixed costs include rent, utilities, payroll, taxes and fixed marketing expenses. Here’s a formula you can use to calculate the cost of servicing a client

Hours spent on client / Total hours spent * Total Fixed Operating Costs = Cost of servicing a client

This requires disciplined time tracking – at the client level and firm wide. The more accurate your data the more telling this metric is.

Here’s why this matters

- You’ll get a clear idea of the quality and quantity of the work you’re doing for each client

- You can identify which clients are profitable in the short and long-term

- Assess which practice areas are worthwhile from a financial standpoint

With a little bit of digging, you can quickly identify the markers, red flags and identifiers of an unprofitable client. With a well-designed marketing funnel and the right data, you’ll have the knowledge you need to attract more of the promoter clients your firm needs.

3. Realization

As far as performance indicators go, realization is fairly straightforward. It’s the answer to a simple question. Of the time that’s billed, how much comes back to your firm as revenue?

Realization includes the following firm wide metrics:

- Amount of work done vs. amount billed

- Revenue billed per month

- Revenue collected per month

- Monthly expenses

- The accounts receivable lifecycle (the amount of time between you doing the work and receiving payment)

- Any discounts and/or write downs (before billing)

- Write offs after billing.

This data is key.

Realization gives you the ability to forecast. It’s a simple and straightforward way to assess your firm’s financial performance.

- Use these metrics to identify problem clients

- Clients who pay well and pay on time

- Which practice areas are profitable or unprofitable

- Whether your collections policies need improvements to capture more revenue

- Whether your time tracking methods are accurate

The data from realization is essential because it confirms your firm’s financial performance. With the right details, you’ll be able to increase revenue, decrease expenses and decrease losses.

4. Profitability

Clients aren’t created equal. One client can be more profitable than another. Some practice areas are more profitable than others. When it comes to measuring profit you’ll want to take a layered approach.

Determine profitability by:

- Client

- Firm

- Partner

- Practice area

- Timekeeper

This gives you the granular data you need to find and address financial problems. The basic formula for calculating profit looks incredibly simple.

Revenue – cost = Profit

In reality this isn’t that simple. It really depends on the billing model you use in your firm. Do you use a cost-plus, fixed price or value-based model? How do you determine costs? These questions aren’t as easy to answer, as you already know.

It’s something you’ll need to define for your firm.

5. Individual performance

Which attorneys are your top/bottom performers? Which employees are financially profitable? If you’re looking for an answer to that question you’ll need to assess your attorney’s individual performance.

Here’s what I mean.

Let’s say attorneys in your firm have a maximum of 60 hours available in a week to bill clients. You decide to use this as your benchmark. If your attorney bills at $200 per hour that means the maximum they can earn for that week is $12,000 per week or $48,000 per month.

Here’s the math:

60 hours (total) x $200 per hour = $12,000 potential per week.

If this attorney only brings $7,500 hundred per week in that’s a 63% collection rate. You’re able to instantly gauge whether he’s performing as expected.

You can calculate this for the entire firm, groups in the firm (e.g. first year associates), and individuals.

Here’s why this matters

Measuring individual performance enables you to:

- Maintain cash flow and profitability in your firm

- Identify A players, A player potentials, B and C players

- Set and maintain financial goals/benchmarks for your firm

Attorneys and those who produce billable work are judged primarily by the amount of billables they produce for the firm. Does this mean this is the only metric that matters?

Not at all.

But it’s the metric with the most immediate value.

6. Satisfaction (clients and employees)

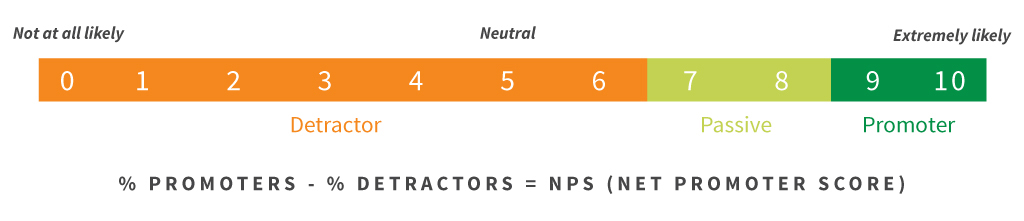

Client satisfaction can be distilled down to one simple question.

“On a scale of 0 – 10, how likely are you to recommend us?“

This is taken from the NetPromoter score.

- Promoters are loyalists. They’ll spend more money with your firm and they’ll refer other clients, driving growth.

- Passives are unenthusiastic but satisfied with your work. They’re opportunists who are vulnerable to competitor poaching.

- Detractors are unhappy clients who will use reviews and word-of-mouth as a weapon to damage your brand and restrict growth.

This is crucial because it tells you where to spend your time and attention.

- Spending 80 percent of your available time on promoters keeps them happy and passionate about your firm. Continue to look for ways you can add value to these clients.

- Offer lukewarm passives three to five percent of your available time, inviting them to become a detractor or promoter.

- Give detractors 15 to 20 percent of your available time as long as they meet one condition. They qualify as unhappy, misinformed or underserved in some way. Ignore ragers, irresponsibles, trolls, users and abusers.

Use automated review and reputation management software to attract reviews and client attention.

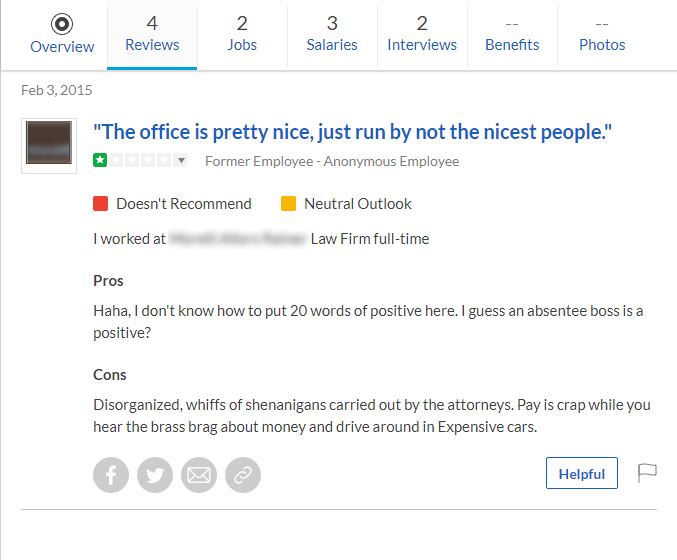

Employee satisfaction is a bit more involved.

This comes down to a simple strategy you can use to gauge employee feedback.

A 360 degree feedback assessment removes the fear, resentment and unnecessary conflict that comes with the feedback process. It can be difficult to manage but you’ll need a few details to make these reviews effective.

- Outline review policies (e.g. be honest, be kind or be quiet)

- Vet reviews ensuring they comply with policy

- Provide examples. Show staff how to give good feedback

Give everyone the opportunity to review everyone else in the firm. This is painful but it’s good for the firm in the long term. It gives firm leaders a chance to address their blind spots before it becomes a major problem. This protects the firm in several ways.

- This feedback provides radical candor boosting employee trust in peers and firm leadership

- It gives law firms a chance to deal with their dirty laundry before it ends up in a review or on Glassdoor

- This feedback keeps leadership humble and open to change

- Provides the firm with consistent opportunities for growth

- Reduces the odds of a mass exodus of associates and partners from the firm

- Improves employee performance and client satisfaction by proxy

Research shows that 360 degree feedback increases staff performance significantly year over year. It’s not perfect, but it’s an excellent way to foster trust in a firm.

Maybe you’re interested in a different set of metrics?

These metrics are the basics.

They’re a firm wide overview of your practice. The number of performance indicators you can measure is near limitless but in this case, less is more. A comprehensive amount of data is not as helpful as many of us have been led to believe.

You know your firm best.

Start with the basics, the data that tells you how you’re doing and where you need to improve. Then add in the data that gives you a customized view of your firm’s performance.

You know your firm is performing well when…

These metrics provide you with the data and evidence you need.

Most firms track a few of these performance indicators. But how many firms make it a habit to monitor these key performance indicators?

Not many.

True, these metrics don’t always deliver the best news. Sometimes our gut feeling is wrong. Sometimes we’re not doing as well as we thought. These firm wide metrics are an important part of our growth. If you’re looking to grow your firm you need this data.

Why?

Because even if it’s bad news, it’s good news to know.

Knowledge provides direction.

It’s a simple and straightforward way to gain clarity about your firm’s performance. There’s no guesswork involved, no indecision on what needs to be done. Measure the right metrics and you’ll know what to fix and when, ensuring that you’re never off track again.