Hard Costs vs. Soft Costs: Everything Law Firms Should Know

07/19/2024 By Allison Lemasters

As an attorney, you encounter a variety of expenses while managing cases and providing services to clients. These expenses, charged on behalf of your clients, must be accurately accounted for in your firm’s books.

You’ll deal with two types of expenses: hard costs and soft costs. Knowing the distinction between them and how to handle each in your accounting is crucial. Let’s break it down.

What Are Hard Costs and Soft Costs?

All of your law firm’s expenses are broken down into two categories: hard costs and soft costs.

Hard costs, also known as direct costs, are those expenses your firm incurs on behalf of a client that require direct payment to a vendor. These costs are tangible and easily traceable to a specific client or case. Typically, you pay these upfront and later seek reimbursement from your clients. They are classified as law practice expenses and deducted from your firm’s income.

Soft costs, or indirect costs, differ in that they do not require direct payment to a vendor and often cover more general, operational expenses. These costs can be more diffuse and are often part of the daily functioning of your firm. Some firms charge these costs to clients, while others absorb them as the necessary costs of doing business.

Examples of Hard and Soft Costs

If your firm pays a court filing fee directly for a client case, that’s a hard cost. Other hard costs may include:

- Court filing fees

- Court reporter fees

- Mediation fees

- Hearing transcript fees

- Expert witness fees

- Travel expenses

- Medical records fees

- Subpoena fees

If your firm charges for the photocopies you make using your own office equipment, you incurred costs but didn’t have to pay a vendor. This scenario would be considered a soft cost. Other soft costs may include:

- Photocopying

- Telephone services

- Internet services

- Printing costs

- Legal research material

- Postage and shipping

- Office supplies

- Software licenses

To further clarify how to categorize each, let’s examine a practical scenario. Think about the last time you paid a filing fee to the court for a client’s case. This expense is a hard cost because it involves a direct payment to a specific vendor (the court). You would record this payment as an accounts receivable, billing the client for reimbursement.

In contrast, consider the scenario where your firm uses its office photocopier to make copies of documents for a client’s case. You incur costs (such as toner and paper) but do not make a direct payment to an outside vendor for each copy. This is a soft cost. While you might bill the client a nominal fee per copy, the cost is generally part of your firm’s overhead.

Resources to Track Hard Costs and Soft Costs at Law Firms

Tracking your law firm’s expenses accurately is crucial for maintaining financial health and ensuring client transparency. The right legal time and expense software can make this task seamless, allowing you to keep detailed records and avoid any financial discrepancies. Let’s look at a few software features that streamline this process for legal professionals:

1. Time and Expense Management

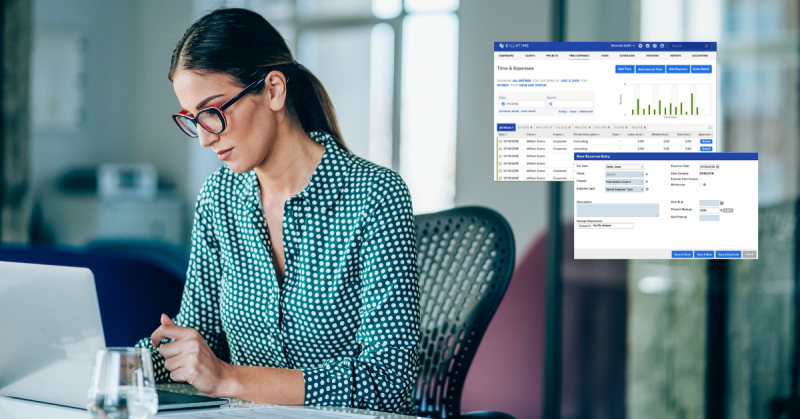

Time and expense tracking is the foundation of accurate accounting in any law firm. Using software like Bill4Time, you can capture your time in real-time on any device, which means no more relying on outdated methods like spreadsheets or notepads. This level of precision ensures that every minute you spend working on a client’s case is accounted for, preventing lost billable hours and making sure you’re compensated for all your efforts.

Now, here’s the trick: with Bill4Time, you can meticulously track both hard and soft costs. These might seem minor, but they add up. With detailed tracking, you can document and account for even those small, often overlooked expenses. This way, capturing transactions incurred on behalf of a client for reimbursement is incredibly easy.

2. Custom Reporting

To truly understand your firm’s financial health, you need more than just basic accounting data. Bill4Time’s custom reporting feature provides a comprehensive view of your firm’s financial activities. Whether you need to review your overall accounting activity or look into specifics like payment history, expenses, or collections by client or matter, these reports help you identify gaps and issues.

With custom reporting, you can also see where your firm is spending the most money or which clients have outstanding payments. This insight allows you to make informed financial decisions and improve your firm’s profitability.

3. Invoice Templates

Clear communication with clients about charges is essential to avoid confusion and maintain trust. Standardizing your legal invoicing process with Bill4Time helps you generate transparent invoices quickly and effectively. This feature speeds up the invoicing process and ensures consistency across your firm.

Having a well-defined invoice creation process as part of your firm’s legal billing policy is crucial. With Bill4Time, you can create custom invoice templates tailored to your firm’s needs. These templates reduce the time it takes to generate invoices and ensure that each invoice clearly communicates hard and soft costs. Providing clients with detailed, easy-to-understand invoices reduces the likelihood of disputes and improves client satisfaction.

Importance of Tracking Hard Costs and Soft Costs

Understanding your firm’s financial health hinges on keeping track of both hard and soft costs. Here’s why it’s so important and how you can do it effectively.

Accurate Finances

Hard and soft costs should be tracked differently for accounting purposes. By categorizing these expenses correctly, you ensure that your financial records are precise. This accuracy helps in billing clients for the appropriate reimbursements and understanding the true cost of running your practice.

Billing Accuracy and Happy Clients

When you bill clients for costs your firm has incurred, it’s essential they understand what these costs are and why they were charged. Clear, detailed invoices that differentiate between hard and soft costs help clients see exactly what they’re paying for, which boosts client retention and minimizes conflicts over charges.

Compliance

Compliance with legal billing standards is non-negotiable. Legal billing must align with the American Bar Association, state bar guidelines, and Interest on Lawyers’ Trust Accounts (IOLTA) regulations. Accurate billing and expense tracking are mandatory to meet these standards. By keeping meticulous records of your hard and soft costs, you ensure your firm stays compliant with all necessary regulations, avoiding potential legal issues.

Final Thoughts on Hard Costs vs. Soft Costs

Effective expense tracking is key to running a profitable law firm. Managing hard and soft costs efficiently not only improves your firm’s financial health but also builds trust with your clients. Software features like Bill4Time’s law firm invoicing and expense tracking make this process seamless. They help you categorize expenses accurately, bill clients transparently, and stay compliant with legal standards.

Using Bill4Time, your firm can handle the complexities of hard and soft costs with ease, ensuring that your finances are always in order and your client relationships remain strong. Someone from our Bill4Time team would be happy to show you how this works — schedule a demo to get started!