Housekeeping For Law Firms: Closing Out the Year

12/21/2018 By Bill4Time Staff

It’s just 8 percent.

Research from StatisticBrain suggests that only 8 percent of people achieve their New Year’s Goals. In fact, 80 percent fail by February.

What if you were different?

What if you were able to routinely set and achieve your goals for the year? What if you were able to plot a stable course for your law firm to follow, setting the stage for your best year ever?

The 8 percent do it. Can you?

Of course, you can.

While there are a variety of strategies and tactics you can use to push your firm further, they’re all bound to fall flat if you’re missing an important detail.

The previous year.

That’s right. The way you close out the previous year sets the tone for your upcoming year. There are several reasons why closing out the year properly is important.

- No man rules alone. You’ll need an assortment of people – clients, partners, associates, and support teams – to move your firm in the direction you’d like it to go.

- Weaknesses and failures. Did you reach your goals for the year? Is revenue decreasing? What’s your profit per partner/employee? How’s your utilization and realization rates? Where did performance fall short?

- Strengths and wins. Where did you outperform your peers and competitors? Which practice areas are the most satisfying/profitable? What are the 20 percent of outcomes that produce 80 percent of your positive results?

- Goals and objectives. Based on your performance, on your firm’s performance, what would you like to change? What needs improvement? What specific goals and objectives can/will you set for the upcoming year?

- Leverage and compounding. How do you multiply your efforts? Which tasks can you delegate, outsource or automate? What can you do to compound the positive results you’ve achieved in the previous year? Can you use leverage or compounding to turn a weakness (or failure) into a win?

This is precious data.

But it’s only available to firms that choose to close their year out properly. That’s easier said than done though, isn’t it? It’s not as if you have a list of to-dos you can simply reference when you need them.

Actually, you do.

I’m about to share a detailed list of housekeeping tasks you can use to close out the year properly at your law firm. Doing this right will provide you with the data you need to ensure you’re part of the 8 percent.

Are you ready?

Let’s get the more taxing housekeeping projects out of the way first.

Project #1: Data collection and tax preparation

In my previous post, I mentioned a short list of data you’d need to collect ahead of time. I’ll briefly recap that list here for your convenience.

- Expenses and deductions (e.g. bills, receipts, canceled checks, etc.)

- Inventory and equipment data

- Depreciation data

- Personal and business deductions

- Vendor bills

- Loan agreements

- Legal paperwork (e.g. parties in lawsuits, purchases, settlements, acquisitions, civil defense, etc.)

- Medical, insurance, payroll and employee records

- Your income and financial statements

- Theft or loss documents

- Corporate payroll data

- Employee documents (e.g. policies, dress codes, CLE requirements, W-2 reimbursement policies, etc.)

- A copy of your schedule K-1, (if applicable) which outlines shareholder income, losses, deductions and credits

These are the basics.

This documentation is the foundation, these are the core details you’ll need to provide to a third party (e.g. accountants, the IRS) for a variety of planning and verification purposes. As I mentioned previously, this list is by no means comprehensive.

It’s a helpful starting point.

You’ll need to work with your accountant or CPA to establish a more comprehensive list of documentation.

Project #2: Audit preparation

They’re prepared for this.

The IRS has spent a considerable amount of time training their auditors and examiners. They’ve released a helpful guide on auditing lawyers. They’ve previously revealed that they are monitoring specific groups closely, which is, of course, their right.

It’s subtle but it isn’t new.

They’ve warned attorneys for some time that these details were coming.

- IRS finds the legal profession a fertile hunting ground (via Washington Post)

- Is the Revenue Service Targeting Lawyers?

- Dear Lawyers: Get Ready for IRS Audits! (via Forbes)

They’ve ramped up over time.

So what?

What specifically does this mean for firms looking to close out the year properly? If you’re consistently using a practice management solution like Bill4Time your house is in order. You should prepare:

- Comprehensive copies of your timesheets/records for each timekeeper whether they’re still with the firm or not

- Billing statements, invoices, and a record of any write-downs or write-offs over the course if your fiscal year

- Client documents, records of previous cases, employee files, expenses, etc.

- Receipts, journals and or ledgers

- Accounting documentation (income statements, balance sheets, financial statements, etc.)

You’ll want to collect all of this in addition to the details mentioned above. You’ll want to work with your financial team to verify that (a.) you have the documents you need to come through an audit successfully. (b.) that your documents corroborate any claims made and (c.) that you’re able to verify each claim.

In an ideal world, you’re already prepared.

Collecting this data as you approach the end of the year gives your financial advisors a clear track to follow. If you have the documentation and corroboration you need you should be prepared.

Project #3: General to-dos

You’ll want to take care of any generic or routine end of year tasks.

These tasks can include:

- Archiving, destroying or backing up data per your document retention policies.

- Archiving current year files and starting fresh for the next year

- Improve and iterate on systems and procedures (e.g. client intake process, marketing funnels, etc.)

- Assess CLE requirements for employees in your firm, verifying that annual requirements have been met

- File corporate reports

- Pull your personal and/or business credit reports

- Verify employee payroll data

- Assess savings, investments and retirement disbursements

Keep track of general to-do items.

You know the ones. If there are any general to-do items that need to be done before the end of the year now’s the time to add them to the list.

Project #4: Building + dismantling relationships

No one rules alone.

If it doesn’t already, your firm will at some point rely on a mix of professionals. You’ll need shareholders, partners, associates, support and administrative teams to grow. Closing out the year properly means rewarding and acknowledging the professionals who have brought you this far.

How?

- Cards and gifts for key employees, freelancers and professionals on your team

- Awards, bonuses and recognition for top performers

- Promotions and additional performance incentives (e.g. a lease) for A players

- Affiliate, partner and vendor rewards

- A kind word or quiet expressions of gratitude can build key relationships

- Mending fences and dealing with disputes and poor incentives

This is the acknowledgment, the reward your team needs consistently to grow. What about the relationships you need to dismantle and abandon? These are the relationships that tear you down, making it difficult to grow your firm.

- Teammates with low EQ

- Poor character, mismatched values or conflicting morals

- Teammates locked in an intractable conflict

- Unreliable partners, employees, vendors or affiliates

- Toxic or dysfunctional teammates who are certified and thrive on conflict.

It’s a good idea to take stock of your relationships. You’ll want to identify the relationships that move you, the firm closer to where you’d like to be at the end of next year. You’ll also want to identify the relationships that take you further away from your goals.

It’s essentially an inventory.

A word of caution here though. You’ll want to avoid throwing people away. Take care to avoid burning bridges too quickly. If a relationship can (and should) be salvaged, you’ll want to take the steps needed to do so. If there’s a chance at reconciliation, take it.

Project #5: Stress testing and disaster recovery

Moses, Afonso, Ryan, a law firm in Providence was attacked via Ransomware. Cybercriminals encrypted all of the data and files on their network for three months. Their attackers demanded $25,000 in ransom for the return of their files.

It was an evil and vicious attack.

Then, to make matters worse, their insurers refused to cover the loss. They filed suit claiming that Sentinel, their insurer was responsible for the loss. They lost an estimated $700,000 in billings.

Excruciating.

They were able to recover their files but so far, they haven’t been able to recover the $700,000 in lost billings.

The point?

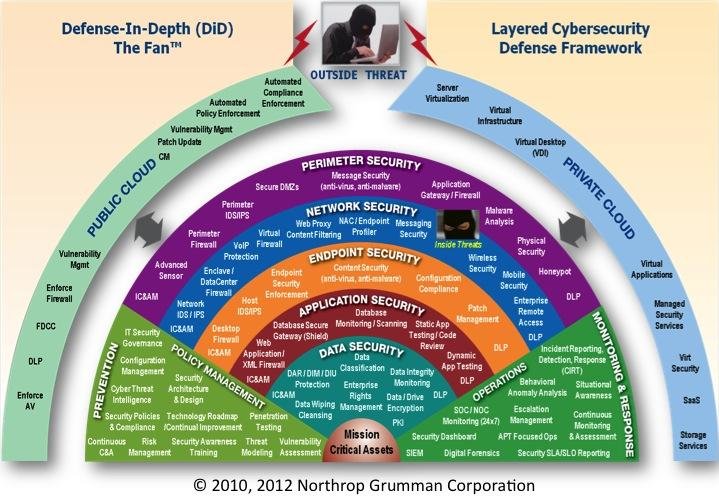

Cybercriminals are ramping up their attacks on law firms. Ransomware attacks alone have increased by 250 percent. Naturally, this means firms are beefing up security in response, right?

Actually, no.

Many firms are forgoing the basic protections they need to survive a cyber attack. According to an ILTA survey, most firms aren’t covering the basics.

- 86% do not use or require two-factor identification

- 78% do not issue encrypted USB drives

- 76% do not automatically encrypt content-based emails

- 58% do not encrypt laptops

- 87% do not employ any laptop tracking technology

- 61% have no intrusion detection tools

- 64% have no intrusion prevention tools

- 94% don’t bother to track the smartphones that are used for professional work.

Things have improved slowly since this survey, but most firms, particularly small firms, continue to lag behind. Can you imagine dealing with a ransomware attack and audit in the very same year?

You shouldn’t have to.

Your firm should be protected from disasters like these. How do you end the year on a high note?

You plan.

You seek out the help you need to implement a defense in depth strategy.

Some easy first steps for the end of the year?

- You start with the basics. Turning off computers at night, anti-virus software, using passwords, establishing user rights, backing up data, etc. Basics.

- You seek out a competent network/security professional to help you establish your firm. Then you ask (pay) them to create a plan that provides defense in depth.

- You implement the plan slowly, as you’re able, taking consistent steps to improve the security of your firm.

- You select a cloud-based, practice management and document management system to outsource major portions of your data and security management to a stable third-party You minimize the amount of data, updates and backups you’re explicitly required to back up.

Why bother?

Because (a.) you’re legally and ethically responsible for your client’s data in your position and (b.) you’re required to protect that data and (c.) 46 out of 50 states, as well as the District of Columbia and the Virgin Islands, have laws that require you to notify your clients in the event of a breach.

The most important reason?

If you’re competent, a secure law firm improves your ability to attract, win and retain profitable clients.

This is what the 8 percent have

Can you see it?

The 8 percent of top performers, they’re able to set and achieve goals routinely. What makes the difference? They focused their attention on closing out their previous year properly.

They know the secret.

The way you close out the previous year sets the tone for your upcoming year. They track important metrics – their relationships, failures, wins, goals, and leverage. They take an honest look at their year.

Then they make a decision.

They use the end of their year to set the tone for the upcoming year.

You can do it too.

With the right approach, you’ll have the tools and resources you need to produce outstanding results. Eighty percent of new year’s resolutions fail, but that doesn’t mean 2019 has to be a failure for you. Mine the previous year for the precious data you need.

With the right housekeeping, a bit of decision-making, you’ll be part of the 8 percent. You’ll have the structure you need to create your best year ever.