How Online Payments Support Cross-selling for Law Firms

08/24/2021 By Andrew McDermott

Cross-selling for law firms is not only great to build revenue, but it helps retain more clients by becoming their “one-stop shop” for legal services. Sixty percent of firms see retaining clients as a significant challenge. Competition from likeminded firms and industry disruption continues to erode client/law firm relationships.

The solution? Using online payments to cross sell the services at your law firm. This strategy isn’t new, but it is effective. Let’s take a look at a few strategies you can use to increase your firm’s revenues by as much as 17x your current revenues.

Use your client’s (saved) billing profile + tangential problems

The S word tends to conjure up cringe-worthy images of used car salesmen, sleazy infomercials pitchmen and hustlers who refuse to accept the word No. That makes sense; it’s also part of the reason why so many lawyers seem to dislike the idea of selling.

It’s a perception problem. When we understand the scientific principles behind “selling,” it suddenly becomes easier to attract, convert and retain new clients. I’m talking about our negative bias.

John Cacioppo, Ph.D., discovered that our brains have a negative bias. Our brains are tuned to seek out negative information obsessively. This is present even before birth. We respond more strongly to stimuli we’ve flagged as negative.

What does this have to do with your clients?

Your client’s negative bias means they come to you with specific problems they’d like you to solve. Here’s the good news. Every solution creates a new set of problems clients need you to solve.

Here’s an example.

- You set up an LLC for your clients.

- They’re running a consulting firm, so you ask about agreements. They hire you to craft a range of agreements for them.

- You ask about their estate plans. They’re aware of a new problem that you’re able to solve.

- You help your client with their commercial real estate lease or purchase — more business.

- They acquire a significant amount of assets. Those assets need protection. More work for you.

Cross-selling for law firms means you’re offering your existing clients solutions to the additional legal problems they don’t know they have. You’re not manufacturing a problem. It’s the opposite. You’re telling clients about the problems that are waiting to ambush them. Then, you’re solving those problems for a price.

This is the power of our negative bias.

Say nothing to your client and their business and assets remain unprotected. Avoid bringing up their lack of agreements, and you leave their consulting business vulnerable to a lawsuit.

See what I mean.

How do online payments support cross-selling for law firms?

If you have your client’s credit card information on file, the cross-sell is easy and simple. Just ask your clients to say yes, bill the card you have on file and continue to handle the matters they present you with! The easier it is for clients to pay you, the easier it is for you to increase your cross-sells.

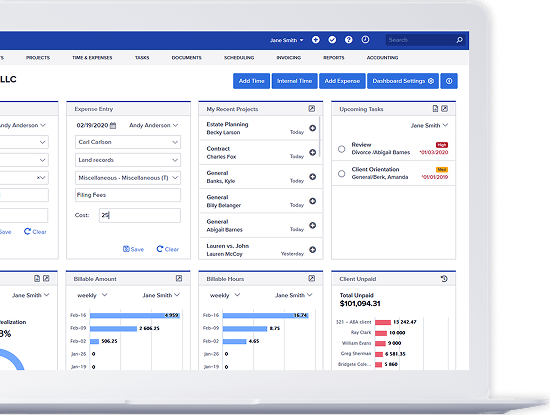

But it starts with saving your client’s credit card profile. Built-in payments processors like, Bill4Time Payments, allows your clients to easily pay online and safely stores their information for future payments. This way, you’ll have the reporting and data you need to suggest cross-sells consistently.

Use online payments reporting + origination credits to boost revenue

A recent study via Law.com found clients who were served by three practice groups had revenues that were 5.7 times higher than those served by one. Clients who were served by five practice groups generated fees that were 17.6 times higher than those served by one.

This is a massive increase.

How do you make this happen in your law firm? It’s simple. You create (or revamp) the origination policy in your firm. Remember the billing profile I just mentioned? That’s an indispensable part of this process. You’re going to need that.

Here’s how you use it.

1. Contact existing clients who’ve already submitted a saved billing profile with your firm. Whenever possible, request credit card data from clients in place of checks or wire transfers. For many practice areas, credit/debit card data can be your default payment method.

2. Reach out to trustworthy attorneys in your firm and offer them generous origination credit if they help you close existing clients on new matters. Finally, use the reporting provided by your online payments provider to keep track of origination credits.

3. Pitch clients on specific attorneys in your firm who can deliver results or help them solve a particular problem. You’re looking for specialists rather than generalists. Rely on trustworthy attorneys to help you close the business.

4. Repeat these steps, working to generate new business for your colleagues, provided that you receive origination credit for your hard work, referrals and access to your client. You’ll want to ensure that you’re compensated well for your referral. Use the reports provided by your practice management software or payment processor to determine who gets credit for what, how much and why.

Here’s why this simple, almost boring strategy works so well.

A 2012 study by Randall L. Rose et al. found that consumers who use credit cards spend more than double, more than if they had simply paid via cash, check or wire transfer. A saved billing profile means clients are focused on the potential benefits of your pitch, not the cost.

They just have to say yes.

Why online payments work

A strong origination plan combined with saved billing profiles or credit authorization means it’s easier for clients to bring in a large yet consistent amount of revenue. Sixty percent of firms see retaining clients as a significant challenge. Competition from likeminded firms and industry disruption continues to erode client/law firm relationships.