Just Released – Late Fee Advancements!

02/15/2016 By Bill4Time Staff

Need a quick way to track overdue fees from past due invoices? With the new Automated Interest feature in Bill4Time, it’s never been easier. You have the ability to turn on or off whether you would like interest to be calculated automatically or if you would like to continue manually applying fees to invoices.

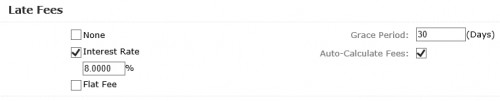

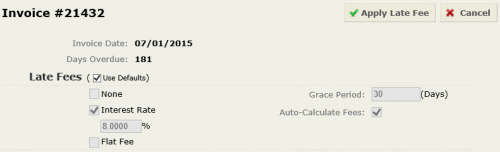

Under Invoice Setup you can check the box next to Auto-Calculate Fees along with entering your Fee Type and Grace Period. Once that is saved, the system will automatically track your interest based on your settings. These settings can also be changed per Client and Project.

From the invoice, you can check to see the amount applied. You can also edit the late fee to make any changes or adjustments if you need to override the default settings. Each day an invoice is overdue it will accrue interest.

Adding a late fee to your invoices gives your clients an incentive to pay their invoices on time. The automated late fee will also give you assurance that valuable time and money is not being lost.