Whether you’re looking at law schools, currently studying law, or mere weeks from graduation, you might have wondered how to start a law firm right after law school.

There are approximately 1.33 million people actively practicing law, according to the American Bar Association. Of these, roughly 26% of those attorneys (345,800) are solo practitioners, according to their 2020 study.

The Bureau of Labor Statistics projects a faster-than-average 8% growth for lawyers — that’s nearly 62,400 jobs from 2022-2023. They also project an additional 39,100 jobs added per year over the decade, resulting from career changes or retirement.

While the outlook looks promising to law school graduates, some might prefer to start their own practices and work for themselves.

Here’s how you can do it.

How to Start a Law Firm After Law School

If you’re starting your own law firm straight out of law school you’ll need to choose your practice area. Believe it or not, this is an incredible opportunity. You get the chance to chart the course of your career!

Here are a few simple guidelines to follow.

Choose a practice area that interests you.

Interest determines attention. Attention, specifically the level of attention exerted, determines the quality and longevity of your work overall. The obvious point here is this: it’s much harder to do a good job when you hate your job.

Verify that there’s an appropriate level of supply and demand.

In the 1990s, market conditions forced most law school students to choose litigation as a practice area instead of corporate or transactional law. Be sure your ideal area of law has ample space for your law firm, and if it doesn’t, follow best practices to get your firm’s name out there.

Make sure you have the required skill sets.

You’ll want to analyze your personality and temperament, academic and/or professional credentials (i.e. a patent attorney with an engineering undergraduate degree) ahead of time before settling on a particular practice area.

Here are a few additional primers on choosing the right practice area(s).

- Researching and Choosing Practice Areas – Harvard Law School

- Choosing a legal practice area: five tips – LawCareers.net

- How to expand your legal practice areas by addressing key challenges – Thomas Reuters

- Careers In Law: Which Path Is Right For You? – Forbes

How to Set Up a New Law Firm

Once you’ve determined the name, legal structure, and focus of your law firm you’ll need to create a firm foundation. This is the core component most attorneys miss. Your new firm needs structure, in the form of systems and procedures, to survive.

These are the fundamental components you’ll need (in order of importance) to build a successful legal practice.

Financial Management

You’ll need positive cash flow and strict financial controls governing how money is handled in your firm, who has access to what and when. You’ll need concise, actionable reports delivered daily, weekly, monthly, quarterly and annually.

Communications Management

This is a catchall term that describes business development, sales and marketing. Communication is how your firm attracts new leads and clients. Poor communication = a cash poor legal practice. Make sure you have an all-in-one law firm management software that allows your team to communicate seamlessly as you grow your practice.

Legal Management

Your area of expertise. This area covers office lease or purchase contracts, intellectual property protection and agreements, loan documentation, compliance issues and more.

Systems Management

Systems run businesses. Systems codify the education and information inside your head. It gives future employees, freelancers and support teams the instructions they’ll need to help you grow, manage and maintain your law firm. Quality and performance management is impossible without systems management. Law firm management software like Bill4Time makes starting and running your own law firm easy.

Service Management

Your service is what your customers pay for. It seems important, and it is. But it’s the least important part of your business. Most solo and small firm practitioners focus their attention exclusively on their service. Good service is unsustainable/impossible without the first four components mentioned above.

Here’s the thing about these components.

Setting up these components properly is much easier when you’re working with real, money-in-hand clients. Let’s focus our attention there first.

How to Create a Plan for Landing Clients

Attorneys with deep pockets tend to throw money at the problem which, as you might expect, doesn’t work all that well. Newly established firms rely on the usual channels – advertising, marketing, speaking, etc. These channels work best when they’re part of a cohesive strategy. When they’re not, they tend to provide limited results.

However — when they’re focused on the right strategy — these channels can help build a new law firm. In fact, business development is easy when focus is in the right place. Building your law firm’s platform will create a space in the market for your brand (in law firm marketing terms).

Platform building.

As mentioned previously, there are two main ways to drive prospective client traffic to your firm.

- Traffic from existing platforms. These are people, organizations, influencers and tangential sources who have already built a platform of their own. Their audience is hungry, desperate for the value you provide. Feed their audience and their platform becomes yours.

- Traffic from a platform you build. You build, manage and maintain your own platform from scratch via your very own marketing campaigns. You create business development content that attracts and segments visitors. You build everything around your audience.

Business Strategies for New Law Firms

Here are some business development strategies you can use to create a thriving platform for your young law firm. These strategies rely on two things: (1) traffic from existing platforms and (2) influencers, powerful kingmakers with influence and reach.

Strategy #1: Writing

This is the easiest way to begin the conversation with clients. It’s writing for other publications, influencers who need content. The platforms you turn to on a regular basis for education? They need your knowledge and expertise.

These publications should meet 3 criteria.

- Publications with authority. The ABA Journal, National Law Journal and The Hill are all authoritative, attorney-focused publications. The Wall Street Journal, New York Times, Washington Post, CNN, Time, and The Harvard Business Review are all consumer-focused publications. Writing for these authoritative publications boosts your authority and prestige, providing you with a greater amount of influence and reach.

- Publications with traffic. Publications like The American Lawyer, Law Technology Today and Trial Magazine are attorney-focused publications. Business Insider, Entrepreneur Magazine, Fast Company, and other high traffic sites are consumer focused.

- Publications with opportunity. These are specialty publications that provide you with opportunities to win new business. In-house counsel publications such as ACC Docket and International In-house Counsel Journal are attorney-focused examples. Key partnerships with any of the publications listed above (and those not listed) may also provide significant opportunity.

These broad examples are helpful cues you can use to get things started.

Strategy #2: Interviewing

Radio shows, podcasts, and discussion panels are always on the lookout for credible experts (you). They need important, educational content to feed their audiences. If you’re going to be a guest on these radio shows, podcasts and discussion panels, what might that look like?

- Divorce attorneys share legal, marriage and relationship advice, helping clients to protect their assets

- Business attorneys share a never-ending stream of advice for startups and small businesses

- Tax attorneys share entertaining investment, tax and legal advice with homeowners and house hunters

Look for the overlap of their topic/focus and your expertise.

You can peruse the list of radio stations and podcasts in the United States. Once you have a list of targets, work on creating a pitch, follow-up offer, product and intake process.

Strategy #3: Teaching

This strategy is one of the best ways to attract a significant amount of attention from prospective clients. Here’s how it works. You partner up with influencers to teach an audience. It could be their audience, an influencer that has signed on to teach, or a cold audience.

The right content matters most. You’ll need to provide influencers with in-depth, long-form content that provides information about high-traffic topic areas.

What does this look like?

- A real estate attorney teams up with real estate developer groups and investor clubs

- Business/startup attorneys could team up with entrepreneur clubs, chamber of commerce, rotary clubs and networking groups

- Intellectual property attorneys could reach out to software directories like Capterra, G2 and GetApp

You’re looking for tangential organizations (or people) with a large pool of potential clients you can serve. Next, you’ll want to provide them with educational tools and resources they can use to serve their audience. Finally, you’ll want to make their audience yours by creating lead magnets.

What’s a lead magnet?

A lead magnet can be a free or paid product, tool, service, quiz or app. It’s a helpful resource that meets the following criteria:

- It shows clients you understand their specific problem

- Shows you know why it’s a problem and what the consequences of ignoring the problem will be

- Demonstrates your ability to solve that problem, permanently

- Gently shows clients their inability to solve their problem

- Gives clients important next steps to contact you/request help

Lead magnets attract attention, create interest, stoked desire and motivate action. They’re helpful tools you can use to quickly build trust, rapport and consensus with prospective clients.

Strategy #4: Public Speaking via Influencers

Public speaking may make some cower, but here are some great examples of lawyers discussing their expertise on large channels:

- Why Everyone Should Go To Law School | Jana Al-Akhras | TEDxNewAlbany

- Joey Jackson – CNN Legal Analyst

- Chris Melcher, Divorce Lawyer, in the New York Times

To become an effective public speaker you’ll need to build relationships that are contingent on value.

What’s the first step of creating value?

The pitch.

You identify a problem, need or desire your influencer needs to be solved. Maybe they need more educational content for their audience, maybe they’re looking for experts to share their insights on a popular or trending topic. Make it your goal to identify and solve their problems.

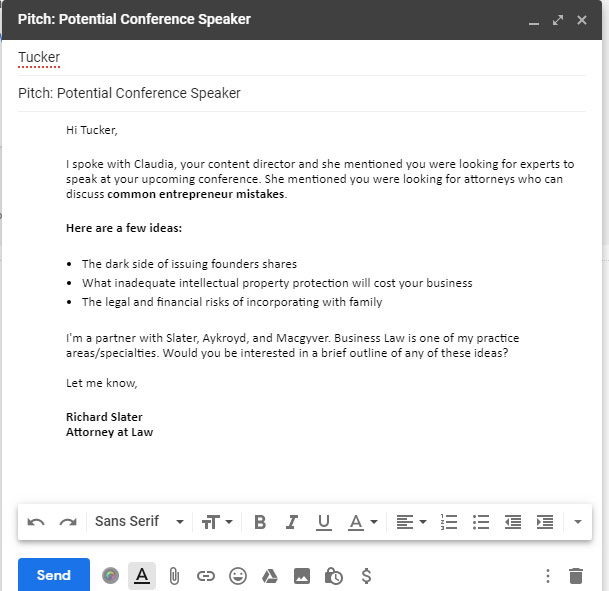

Send them an email with your pitch. Here’s an example:

[Hi Decision maker],

I spoke with [insert name], your content director, and [he/she/they] mentioned you were looking for experts to speak at your upcoming conference. [He/She/They] mentioned you were looking for attorneys who can discuss [topic].

Here are a few ideas:

- Idea #1

- Idea #2

- Idea #3

I’m a partner with [Firm], and [topic] is one of my practice areas/specialties. Would you be interested in a brief outline?

Let me know,

[Your Name | Signature]

It’s concise, focused and all about them.

Remember the steps mentioned in strategy three? You can use the same exact process for public speaking or you can use it to identify areas where you can add value. Once you’re finished speaking, provide listeners with a follow-up offer (consultation, assessment, lead magnet, etc.) at the end of your speech.

Capture their contact info and follow-up where appropriate.

Strategy #5: Take Care of Your Influencers and Their Audience

It’s a hidden business development strategy most attorneys ignore.

People are sensitive.

It’s a wise idea to assume that your influencers, clients, peers and coworkers are all sensitive to the same things. We’re all a bit sensitive to:

- Insults

- Threats

- Bullying

- Abuse

- Humiliation

It’s not as easy to avoid making these mistakes as you might think.

Here are some straightforward ways to avoid making that mistake:

Don’t ghost or ignore people.

Ignoring texts, emails and instant messages harms the relationship. Silence is the worst insult possible. It trains those around you to fill in the blanks. Which of course means they’ll assume the worst.

Don’t assert your power over others.

At any given time, and in any given conversation, one person will always be more successful than another. Casually mentioning the large bonus check you received stings when the associate you’re talking to didn’t get one.

Pay your debts.

Most people collect relational and social stamps. They do good with the expectation of return. What’s worse, the value of the good deed goes up in the giver’s mind and down in the recipient’s. Consistently expressing gratitude for the things others have done for you. It’s a simple and easy way to avoid resentment due to social and relational debts.

Don’t waste their time.

It’s important to zealously guard your time. It’s just as important to guard the time of those around you. Simply saying “I don’t want to waste your time” in a conversation is enough to let people know you value them personally and you value their time. This blends into being on time or early to meetings, respecting that they have a schedule to maintain as well.

Don’t think they’re okay with it, just because you are.

Your values aren’t their values. People have their own way of doing things. Imagine that an associate decided to borrow several items from your desk without asking because they’d be okay with it. Then, when confronted, they mentioned it’s not a big deal and told you to let it go, completely disrespecting your boundaries. That’s how many people feel with this assumption.

It really comes down to this:

Know your audience.

If you’re a junior partner, be aware of the fact that other people at the firm may not have had similar experiences to yours. They may act differently than you would in certain situations.

There’s a simple rule you can follow to take care of your audience.

Build them up.

That’s pretty straightforward, right? This doesn’t mean you morph into a teacher’s pet. It also doesn’t mean that you accept abusive or dysfunctional behavior.

Acknowledge their value, as a human being, as equal to your own.

Some people are driven by agreeableness and social pleasantries. Others loathe chit chat preferring that you “get to the point.”

Meet people where they are.

How to Start a Law Firm with Law Firm Management Software

With all the topics covered, did you catch the secret to launching a successful law firm?

It’s serving others.

Intense education, the number of graduates vying for jobs, competitive opportunities — it all stops mattering when you focus on serving others. It’s the secret to high-performance business development — and nearly unmatched when paired with the proper law firm management software to help your firm succeed.

This blog was originally published in August 2018. Recent update: September 2023.