Attorney credit card services are abundant, yet many law firms are still hesitant to make the switch to online payments. Part of the reason behind this hesitation is a certain degree of uncertainty. Attorneys don’t know what to look for.

They’re not sure about the focus, features, or options that should be included. They’re not sure how to differentiate between one credit card services provider and another. Today we’re going to take a closer look at credit card processors, outlining what firms should look for and what they should avoid.

What attorneys should look for in an online payment processor

If you’re in the market for an online payment processor, it’s a good idea to look for processors who offer the following:

- PCI compliance: Compliance means your provider has taken on the burden of ensuring you, your clients, and your data remain safe and secure. Your credit card service provider should be willing to walk you through a self-assessment questionnaire to verify that compliance is achieved on your end. They do most of the heavy lifting, but compliance is an absolute must. Your provider should be willing to provide you with an attestation of compliance when requested. If they can’t, walk away.

- Strict security protocols: Working with you, your payment processor should be fully capable of protecting sensitive business and client data, whether you’re dealing with data-in-use, data-at-rest, or data-in-transit. They should be able to provide this level of security without negatively impacting your firm’s performance or productivity.

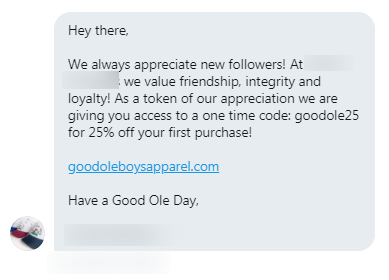

- Open and transparent: Your payment processor should provide you with clear agreements with precise language. They should provide you with a clear list of fees (e.g., pricing is 3.3% + $.60 per transaction + $60 per mo.). If there are any unexpected fees or expenses, these should be disclosed clearly and completely before you sign on the dotted line.

- Attentive customer service: It’s a good idea to identify what you want first. Do you want your payment processor to provide you with the handholding you need, or would you prefer them to process your payments and leave you alone? Determine what you’re looking for first, then find a reliable provider who’s willing to accommodate. Remember the adage, “how they sell you is how they’ll serve you.”

Third party processors can be a hassle and may not meet legal standards for accepting online payments. Attorneys should look for payments processors that are easy to use with transparent pricing. Built-in processors, like Bill4Time Payments, are compliant and offer industry-low fees. The feature is accessible within your Bill4Time account and easy to activate.

Attorney credit card services are straightforward

Many law firms are still hesitant to make the switch to online payments even thought billing software has been show to increase productivity across their practice.

A hidden concern that’s driving their hesitation is the fear that something will go wrong. They’re not sure how to differentiate between credit card services providers. They don’t want to be burned.

With the right education, attorneys will be able to choose the credit card service provider that meets their needs. They’ll be able to identify the focus, features, or options that should be included with their ideal provider, no mishaps necessary.

If you’re not already using Bill4Time, schedule a demo to learn how to get access to Bill4Time Payments and other features to streamline your business.