Do your clients ignore your bill? Is it a hassle to get your invoices paid completely or on time? Maybe lost billables have been a problem for your firm? If so, your invoices may be to blame. Your invoice has a tremendous amount of power. In the right hands, it’s a tool you can use to boost realization rates and confirm or deny the image of your firm. It’s a helpful way to encourage loyalty and support or a surefire way to turn clients off. Here are some best practices for client billing.

Your clients won’t admit it, but they’re terrified

They’re nervous about working with attorneys.

Put yourself in their shoes. Imagine a professional tells you they’re going to help you at the discounted rate of $768 per hour. They’ll let you know when they’re finished working, and then they’ll send you a bill at the end of the month.

Pretty random, right?

As a client, you’re vulnerable and completely in the dark. Will they itemize absolutely everything (e.g., dry cleaning, phone calls, emails, text messages, lunch breaks)? Do they inflate billable hours?

It’s a reasonable question when you come across stories like these.

- An attorney in West Virginia billed 24 hours in one day.

- Another billed 900 hours of travel in one month (there are 730 hours in a month)

- A partner at a prestigious Chicago law firm billed 6,022 hours per year for four consecutive years. She’d have to work 23.3 hours per day for 365 days a year to achieve this.

They have fear that they’ll be cheated somehow.

Read through these examples of overbilling and something interesting stands out. Of the 800 lawyers doing court appointed work in this story, only 100 were overbilling. The others were “billing scrupulously.” When it came to client billing, most lawyers were trustworthy.

Your firm’s image depends (partially) on your billing

In the legal industry, a bill that’s ignored is a missed opportunity.

Best practices for client billing suggest that you focus on the essential elements. That’s important because a missed opportunity on your invoice creates all kinds of little problems for your firm.

- Clients who refuse to pay on time or at all

- Fee disputes from unhappy clients who refuse to pay a cent more than they have to

- Clients spend less time and money with the firm

- The perception that invoices + follow-up is sleazy, offensive or rude

- Losing billables to shrink

- Clients threatening to file a bar complaint

Suddenly, these problems aren’t so little, are they?

Include the correct details on your invoice, and you’re far more likely to receive the payment you deserve. Your clients won’t feel like they’re being nickeled and dimed to death.

Obvious, right?

Only it’s not entirely obvious. The anatomy of an invoice isn’t as straightforward as it sounds. Sure, there are basic details you’ll need to include. There are also hidden details that move your client relationship forwards or backwards.

What’s worse, these details are cumulative.

They’re designed to work together, with the benefits slowly improving client trust over time.

Following best practices for client billing confirms trustworthiness

Your invoices give customers peace of mind. Best practices in client billing show clients you’re…

- Clear. Clients know exactly what to expect. There are no hidden surprises, no gotcha moments where customers are blindsided by an unexpected bill, dollar amount or unfamiliar term. Clarity sets the tone for the relationship, determining whether clients are a fit for your firm, or not.

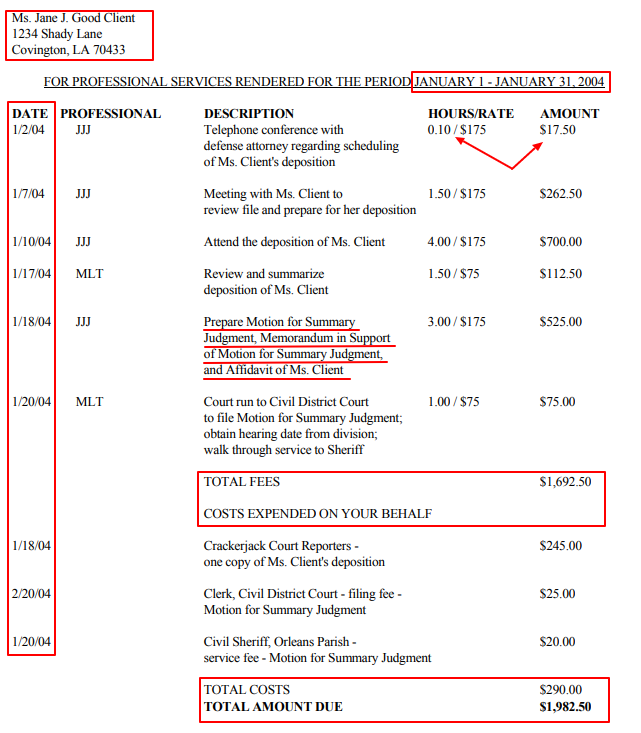

- Transparent. Which line item is more trustworthy, “Prepare motion for summary judgment” or, “Divorce?” Which line item gives clients the impression that you’re working specifically on their behalf? Most people would list the first line item as more transparent.

- Charitable. Unseen discounts, pro bono work, hidden write-downs and write-offs, they do nothing for you or your clients. If you’re giving customers a bonus, incentive or discount, make sure it’s listed on their invoice.

- Setting boundaries. Are your payment terms net 30? What’s your late fee? Your invoice enables you to set subtle boundaries with clients.

Here’s the question though. What should be included in your invoice?

Your invoice should cover three categories.

1. The basics

The barebones data your client needs to actually pay your invoice. This data is the absolute minimum. If you’re using a tool like Bill4Time to track your time this is simple and straightforward.

Your invoice should clarify…

- Who to pay

- Who is responsible for payment

- How much to pay

- When to pay it

- Acceptable payment methods.

- Where to send their payment

If you’re in business and you’re getting paid, you understand the basics. We all understand the basics of client billing so that means we need to focus our attention on…

2. Obvious data

- Your recent / previous payment. This is a form of positive reinforcement. It gives clients a running tally of their recent payments and it shows that their payments were posted to their account. Normally this isn’t something your clients will even look at. This is the first place they’re look if there’s a balance dispute or disagreement about the amount that’s drawn from their retainer.

- Bill date and details. This shows your clients when the bill was printed. Here’s why this matters. Chronic late payers may be wondering why wasn’t my payment reflected on my invoice? This gives you the opening you need to have a conversation about due dates.

- Hours/fees breakdown. This gives clients a sense of your performance and hourly rate. It’s a simple heuristic clients can use to see who did what and when. Is a junior associate taking twice as long to handle something a partner can finish in half the time? Are you accidentally billing paralegals out at senior attorney rates? It’s an easy mistake to make, but it’s also considered fraud.

- Late fees and discounts for early payment. There are obvious and hidden aspects to this, but it’s an easy and straightforward way to set boundaries with clients.

3. Hidden data

- Outlining what you did versus what you gave. An unseen discount is worthless to your client. It’s worthless to you. Even worse, bringing up a discount after the fact is far more likely to create resentment. Clients are more likely to assume that you’re using discounts circumstantially to gain leverage over them.

- Listing work completion dates. This isn’t as common as you’d expect but it’s a helpful way to minimize payment disputes. A detailed breakdown communicates (a.) you’re working consistently on specific tasks (b.) the time spent on these tasks are reasonable and appropriate.

- Payment arrangement details. On the one hand, you probably don’t want to advertise payment arrangements as it may encourage clients to pay late or pay less. On the other hand, it’s something that can be used to encourage delinquent clients to pay vs. dealing with write-downs or write-offs.

- Arranging payment due dates are pretty basic. But there’s also a hidden element at play. When it comes to follow-up, attorneys are notoriously bad at it. It’s incredibly common for customers to ignore an invoice for legitimate or illegitimate reasons. The lack of follow-up is common, but it’s also devastating to your firm’s cash flow.

So why does this happen? There’s a variety of reasons – don’t want to appear needy or greedy. Attorneys don’t want to offend their clients. Here’s what this lack of follow-up really communicates to your client. You don’t need or care to be paid for your hard work.

- Setting rules and boundaries, e.g., rewarding clients who pay early and penalizing clients who pay late. This gives customers a clear indication of where they stand and what’s expected by all. If the rules are clear, there should be no confusion about what you’re doing or what needs to be done. Just make sure it’s reflected in your initial agreements.

These details may not seem like much. But they’re crucial in your client billing if you’d like to avoid:

- Clients who refuse to pay on time or at all

- Fee disputes from unhappy clients who refuse to pay a cent more than they have to

- Clients who spend less time and money with the firm

- The perception that invoices + follow up is sleazy, rude or offensive

- Losing billables to shrink

- Clients threatening to file a bar complaint

It’s essential to include the right details in your invoice, but it’s only half the story. What’s the other half?

Transparency

Namely, what’s the level of transparency you should use for line items? If your firm bills clients hourly, your work is straightforward and simple. Make sure your invoice line items are specific and clear.

It’s never that simple though is it?

Along comes the alternative fee arrangements (AFAs). Options for flat fee and non-billable payments for clients. As it turns out clients like these AFAs; flat-fee options give clients clarity, predictability and peace of mind. These AFAs come with an unpleasant downside, though.

Shadow billing

You know how it works. Your legal billings are set at a flat rate, but you still track and report billable hours. It’s supposed to be helpful. You and your client get to see if the flat rate price you quoted them is in line with reality. They get a flat rate, you receive valuable data to adjust your price for next time.

Bill Josten at the Legal Executive Institute explains why shadow billing is a problem.

Imagine a … “law firm and client agree to undertake a given matter for a flat fee of $1 million. Everyone is happy with this rate and the client feels it represents a fair fee for the work to be performed.

Now the law firm happens to have a particularly innovative attorney who figures out a new way to complete the task at minimal cost. On a billable hour basis, the firm incurs only $50,000 in costs to quickly produce a top-quality result.

The client sees the work product and is thrilled. But when they see the shadow bill they become irate. How could the law firm bill them $1 million for something that took only $50,000 to complete?”

It all depends on your strategy: If you bill hourly, clients focus on minimizing the amount of work done on their behalf. If they need something done, cost becomes a motivating factor (instead of quality), if you bill at a flat rate, shadow billing becomes a problem.

It’s about transparency

When in doubt, obey the law. Be honest, open, and ethical. Give your clients a clear idea of what to expect, because that’s what your clients expect.

They want the right amount of data to maintain trust and openness. So what should you avoid? It’s actually pretty simple. Avoid anything in your invoice that deceives or overwhelms your clients.

Successful legal billing begins with consistent communication

What does communication have to do with realization rates or getting paid? According to the Legal Trends report, 44 percent of law firms list a client’s inability to pay all at once as the most common reason for nonpayment. Firms also state that 31 percent of clients pay late even when they have the funds.

What’s going on here?

Patrick Lamb, Partner at ElevateNext Law, shared his thoughts on the cause of client schizophrenia.

“Firms increased their rates and clients responded by paying less. This finding reflects a fundamental disconnect between firms and their clients. Clients obviously do not believe they are getting fair value for the fees charged. Increasing rates is not going to change that view: indeed, continued price increases will only exacerbate the problem.”

The real problem?

Neither party wants to communicate. Clients are either skeptical that communication will produce any meaningful change, or they’re embarrassed that they can’t pay. So they ignore their firm’s invoice and pay what they want. Firms continue to increase their rates to reduce the overwhelming pressure they face.

Want your clients to…

- Pay your invoices early or on time?

- Pay without demanding sizeable discounts, write-downs, and write-offs to keep their business?

- Pay your invoice immediately without haggling or complaining?

Communication is the key to invoicing success.

If you’ve noticed that your invoice in a billing period will be way off course from your client’s expectations, don’t ambush them with a terrifying invoice.

Pick up the phone and call them.

Let your point-of-contact know exactly what’s going on. Deliver the bad news concisely, clarify the who, what, when, why, and how. Add that explanation to the invoice, so they don’t have to try to remember that you called them on the phone. Let everyone, decision-makers, your point of contact, and the billing department know what’s coming ahead of time.

Wait a minute.

Wasn’t this about avoiding discounts, write-downs, and write-offs? Why should you negotiate with your clients about your invoice?

Clients need to weigh-in before they can buy-in.

If you don’t give your clients a chance to weigh-in, the opportunity to sit with the bad news you’ve just delivered, and to express their dissatisfaction, you won’t get them to agree to pay your invoice. Most attorneys swing from one extreme to another.

- They discount heavily to keep their client’s business (but they lose their respect in the process)

- Or they refuse to discount and attempt to force clients to pay an invoice they don’t want to pay. They win the battle but lose the client.

Communicate with your clients, and you’ll find it’s easier to earn their acceptance.

Invoice acceptance begins with a checklist

A legal billing checklist is a helpful way to boost realization rates. A checklist gives you the upfront time you need to identify the strategy, tactics, tools, and resources required to produce the outcomes you want, even if clients are unwilling to pay what you ask.

A legal billing checklist helps your law firm:

- Identify (and reset) client expectations ahead of time

- Provide you with the intel and leverage you need to keep clients happy and realization rates high

- Troubleshoot billing and realization problems ahead of time

- Spot legal billing headaches and issues before they metastasize into delinquent payments

Solve these problems ahead of time, and you increase your realization rates naturally.

Let’s take a look at the various items in this 16 point checklist.

| Task/to-do | Why it’s important |

| Some clients won’t be interested in paying for your services at any cost. These protocols identify and sort your ideal and dysfunctional clients. This simple step is taken for granted, but it’s an easy way to boost your firm’s realization rates. |

| You’ll need to identify key decision-makers, influencers, and promoters who can get things done in your client’s organization. |

| The more you invest in a relationship with your clients (and key people in their organization), the easier it will be to address billing problems and improve your realization rates. |

| Your clients have a hidden set of fuzzy, implicit, and unrealistic expectations. Identifying these expectations gives you the leverage you need to ensure they’re happy. Why do expectations matter? Missed expectations are the root of all unhappiness. |

| An awareness of your client’s expectations provides you an opportunity to reset/update them (via your fee agreement), so they’re in-line with reality. This reset prevents the relationship from going sour due to financial misunderstandings. |

| If you’re consistently discounting your fees, a fixed fee arrangement may help restore profitability in your firm. Client misbehavior is often an indication of an AFA mismatch. AFAs can be used creatively to boost client responsiveness, boost firm realization rates, and increase profit per partner/employee. |

| Sending clients a large bill with an unexpected dollar amount is a surefire way to trigger a billing dispute. Unexpected billing protocols outline how you go about making the unexpected easier for clients to handle. |

| Discounts erode law firm profits. The reason is simple. Clients want your services. They don’t want your bill. A discount reduction plan provides you with helpful tools you can use to increase realization rates across your firm. |

| If you’re looking for ways to motivate clients to pay on time, nonfinancial incentives (e.g., bonuses, events, workshops, connections, luncheons, favors, etc.) are a great place to start. These incentives provide you with the precious income your firm needs by addressing non-monetary wants. |

| How often should you communicate with your clients regarding their matter? Regarding your bill? (hint: a 5:1 positive/negative ratio is ideal) However, you’ll need to identify the communication interval that works best for your firm. |

| Your timesheets should be treated as inventory. Every line item is a unit of revenue for your firm. You’ll need to identify the time tracking tools that enable timekeepers in your firm to track their time as-it-happens. |

| Are your timekeepers following best practices? Which timekeepers are tracking their time (billable and non-billable) daily? Are their time entries descriptive and accurate? Are they adding time entries as-it-happens or at the end of the day? Accurate time tracking is crucial for a variety of reasons – it’s how most firms are paid, it helps firms measure their utilization rates |

| Complying with your client’s billing guidelines is an easy way to ensure your invoices are paid fully and on time. Client billing guidelines are historically terrible.

This means you’ll need to supplement client billing guidelines with your own. You’ll want to track actions that are required or forbidden. You’ll also want to identify stop words that flag your invoices for review. |

| When are clients reminded about your invoice? How many reminders are sent? Are they sent via phone, email, text, or IM? You’ll want to outline the follow-up systems needed for your invoices. It’s also a good idea to identify the point of contact responsible for reaching out to each client. The attorney handling their account is ideal, but you’ll need to determine what’s best for you. |

| When should you terminate your relationship with a client? How many payments can be missed? What are the conditions or criteria that need to be met before termination takes place? You’ll need to identify key deal breakers ahead of time. |

| When and how do you initiate collections activity? What specific steps should be taken? How do you notify your client? Determining the when and how of collections activity removes much of the emotion from your client relationships – especially if you provide clients with written, upfront communication. |

Invoicing best practices includes good client communication. The better your client communication, the easier it will be to boost your realization rates. Proper client billing, consistent client communication, these are the hidden keys to invoicing success.

When it comes to client billing, one size doesn’t fit all

Billing in the legal industry – it doesn’t have to be complicated.

Your invoice has a tremendous amount of power. In the right hands it’s a tool you can use to confirm or deny the image of your firm. It’s a helpful way to encourage loyalty and support or, a surefire way to turn your clients off.

Your invoice is the key

Your clients don’t have to be terrified. They don’t have to be nervous when working with you. Put yourself in their shoes. Work to become an attorney who’s open and transparent. Imagine sending out a bill your clients are pleased to pay. It’s possible, if you rely on best practices for client billing.

Do that and you’ll find your invoices help to generate the client loyalty and support you need.