What’s the most upsetting part of billing? A fee dispute. Clients aren’t always happy with their bill. In their mind, there’s an abundance of law firms that can do the same things you do. It makes sense then that clients have become dissatisfied with the traditional “per hour model.” They want options. They want you to provide them with alternative fee arrangements (AFAs).

Are alternative fee arrangements the enemy?

Not at all.

A recent legal trends survey found roughly 56 percent of firms used AFAs. What’s interesting about this is the fact that 96 percent of these firms were satisfied with the quality of work provided under AFAs. A previous survey found that 81 percent felt that AFAs were a permanent trend.

So firms are increasing their use of AFAs?

Not so much. Only 37 percent of firms plan to increase their use of AFAs in the coming year.

Uh… what?

That’s right. Law firms discovered that many of their clients want/prefer AFAs. They also discovered these AFAs produced outstanding results for their firm.

So what’s the problem?

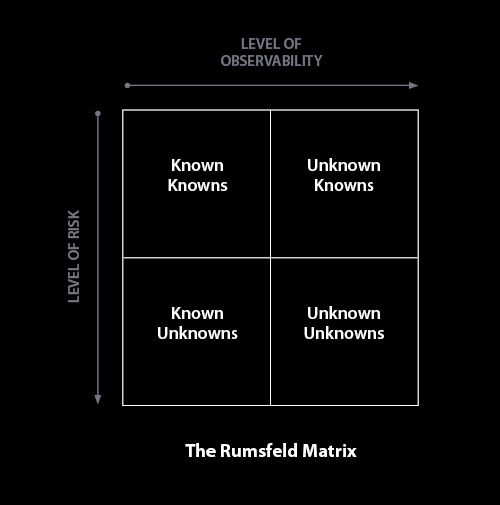

You need to know what you’re doing. These AFAs are risky if you’re careless or inefficient. This doesn’t mean they pose a significant amount of danger to your firm. It means you’ll need to pay attention to what you’re doing if you’d like to achieve good results.

Common sense, right?

Fee arrangements need the Goldilocks principle

Remember the story?

“This porridge is too hot,” Goldilocks exclaimed.

So she tasted the porridge from the second bowl.

“This porridge is too cold.“

So she tasted the last bowl of porridge.

“Ahhh, this porridge is just right!” she said happily.

And she ate it all up.

AFAs need the Goldilocks principle to survive.

Here’s a hypothetical scenario shared by Bill Josten, Legal Analyst at Thompson Reuters.

A law firm and client agree to work for a flat $1 million. The client is happy. They feel this price is fair. The law firm is happy, because the margins are reasonable. The work is rewarding.

Along comes Mr. all-star attorney.

Mr. all-star attorney is ambitious and eager to provide value to the firm. He comes up with a new way to complete the same amount of work, with superior results for a meager $50,000. The quality is top shelf.

The client is pleased.

Until they see the shadow bill. Suddenly they’re furious. How could their firm bill them $1 million dollars for work that only cost $50,000 to produce?

See the problem?

If the law firm spent $950,000 producing the work and billed $1 million, the client wouldn’t have batted an eye. The law firm didn’t cheat their client. They found an innovative way to get the work done.

This is the hidden risk with AFAs.

If you’re too good at your job you sow seeds of distrust and dissatisfaction with your clients. Instead of being commended (as you should be) for your ingenious approach you may actually lose the client.

It’s incredibly unfair.

What if things swing in the other direction?

What if you quote your clients the very same price ($1 million) but the work ends up costing the firm $2 million? If you’re suddenly hemorrhaging money, your clients will expect, no demand that you honor the price you’ve quoted them.

Even if it kills the firm.

You’ll be forced to either (a.) eat the cost of failure and do what you can to survive or (b.) find a legal loophole or stratagem you can use to escape the unprofitable arrangement you’re trapped in.

It’s painful either way.

This is the obvious risk with AFAs.

If your alternative fee arrangements are going to be successful, you’ll need to have a clear idea of how you’ll handle the twists and turns that come with each arrangement.

How many “arrangements” are there?

Choosing the fee structure that’s just right

AFAs, for the most part, are focused on one thing.

Control.

These AFAs satisfy a client’s need for certainty. It gives them clear guidelines they can use to make predictions, estimates and guesses. This is important because clients need to know what to expect.

Let’s take a look.

- Fee caps: Hourly billings are capped at an agreed upon maximum for a given case, project or service. As you might have guessed, this is hourly billings with a slight modification. This arrangement is definitely more beneficial to clients than it is to your firm. You’ll want to watch out for the obvious risks (see above) I mentioned previously.

- Fixed fee menus: This option provides set pricing on a variety of services provided by the firm. Additional flat fee charges could be added to the initial base price. An investment transaction could be billed at $25,000. Added to that, an additional $8,000 fee for assuming a loan. $10,530 for financing and so on.

- Fixed fees for single engagements means firms set a hard price on a several well-defined services. This isn’t ideal for new services or practice areas and it’s not a great fit for inexperienced attorneys. Firms using this AFA need volume to make this arrangement worth their while. This is perfect for services that produce the lion’s share of a firm’s revenue.

- Full contingencies: With these no fee unless we win arrangements, survival depends entirely on success. These AFAs are common with plaintiff and defense attorneys. This AFA works best if your firm has a competitive advantage or noted ability in a specific practice area. Avoid this AFA if you’re unsure of the outcome or results you’ll achieve.

- Holdbacks: A contingency arrangement where a predetermined amount is guaranteed as payment to the firm (say 20 percent). The rest is contingent on the firm’s success in achieving the desired outcome. Receiving fees at 80 percent of your usual rate, with the remaining 20 percent contingent on success. This is often combined with bonus or success fees, further incentivizing firms to deliver results.

- Partial contingencies/Success fees: Similar to a holdback, the firm receives a portion of their fees during the engagement. They receive an additional lump sum at the end of the engagement if they’re successful. Partial contingencies typically define success criteria ahead of time. These criteria are sometimes left to the client’s discretion or spelled out in significant detail.

- Portfolio fixed fees provide clients with a single, fixed price for a large number of services. For example, an organization’s intellectual property engagements over the course of a year. With this arrangement, losses are inevitable so you’ll need a significant amount of volume to come out ahead.

- Retainers: The legal industry’s old faithful. A fee your clients agree to pay every month, for a set period of time, for a specific set of services. These are well known but they’re growing in popularity thanks to the surge in demand for AFAs.

- Risk collars: An hourly billing arrangement that rewards efficiency. With this hourly billing arrangement, attorneys receive a bonus if their work is completed under budget. Clients receive a discount if the work goes over budget. The actual discounts and bonuses vary from firm to firm but it helps to align the client’s/firm’s interests.

- Subscriptions: Similar to retainers, subscription plans give clients access to a specific set of services and engagements for a predetermined price. While retainers have a set timeframe and clear purpose, subscriptions are more universal in their application, continuing indefinitely. Subscriptions require a significant degree of experience as you’ll need to be aware of what it costs to provide a particular service.

These AFAs aren’t created equal.

You’ll need to choose the right arrangement for your firm. They require experience and careful preparation. But, as we’ve seen, these alternative fee arrangements produce a significant amount of value for law firms and their clients.

It’s part of a strong value proposition.

These AFAs make most firms nervous. There’s a concern that you’ll lose money or alienate your clients. But it doesn’t have to be this way. Follow a simple maxim and it won’t be this way.

Plan for the worst, expect the best.

Follow this principle and you’ll have what you need to make these AFAs work for you.

Only _____ firms use alternative fee arrangements

AFA isn’t a dirty word anymore.

Research shows 22 of the 650 law firms serving the Fortune 1,000 rely on AFAs. AFA usage is an at all-time high but it hasn’t gone fully mainstream yet.

Now’s your chance.

It’s your chance to get ahead of your competitors. To establish innovative strategies with your AFAs. To do what other firms can’t or won’t do for their clients.

It’s risky – for the unprepared.

Big law, small to medium sized firms, they’re using AFAs. These strategies aren’t unique to a particular region or practice area.

AFAs could be your savior

The tool that boosts client confidence.

That shows clients you’re willing to take a risk on them. To align your interests with theirs. To alleviate the most upsetting part of the billing process.

The fee dispute.

The traditional model often brings uncertainty and fear. Clients aren’t all that comfortable with the hourly model. In their mind, there’s an abundance of firms that do what you do.

Only there isn’t.

No firm does it quite like you. Your firm is special, unique. Your approach, your experience, your take on the law. It produces value in a way that’s unique to you.

AFAs get clients to listen.

To take a chance with your firm. The research shows AFAs are here to stay. The firms using them continue to grow. Who will win? The firms that master AFAs. It could be you. It should be you.

It will be.

If you start now. Your clients want options. They want you to provide them with alternative fee arrangements. Give them what they want then watch as the most upsetting parts of billing begin to fade away.

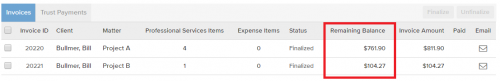

Bill4Time product team releases new and enhanced features, system improvements, and bug fixes several times per week. Organized by month, the Release Notes blog series will highlight all the changes we’ve implemented, so you can easily stay up-to-date on what’s new. If you have a question, feedback, or an idea – please leave a comment below!

Bill4Time product team releases new and enhanced features, system improvements, and bug fixes several times per week. Organized by month, the Release Notes blog series will highlight all the changes we’ve implemented, so you can easily stay up-to-date on what’s new. If you have a question, feedback, or an idea – please leave a comment below!