LinkedIn has 1 billion people from more than 200 countries — plenty of potential clients and connections for lawyers who know how to work it. If you’re not using it, you might be missing out on business.

Need some tips on what to post and how to network effectively? Keep reading for the straightforward advice you need to stand out and grow your practice on LinkedIn.

Is LinkedIn Worth It for Lawyers?

LinkedIn is definitely worth it for lawyers. Folks are spending nearly 2.5 hours on social media a day, and some of that time is spent checking out businesses, including law firms like yours. If you’re not active on platforms like LinkedIn, you’re leaving money on the table and missing out on connecting with clients who might be looking for your services right now.

Social media allows prospective clients to get to know your law firm before they even reach out. When they see your posts on LinkedIn, it increases your visibility and brand awareness. They might click through to your website, learn more about your services, and decide to schedule a consultation.

LinkedIn is also a preferred platform for networking. Sharing relevant news and articles allows you to establish yourself as a knowledgeable professional in the legal community. Doing so enables you to build connections with other industry professionals and remain engaged with current developments in the field.

How Many Law Firms Use LinkedIn?

Around 87% of law firms use LinkedIn, according to the American Bar Association’s latest Profile of the Legal Profession. In this same report, LinkedIn is listed as the number one place law firms market themselves, digitally and on paper.

LinkedIn’s widespread use among law firms is driven by its ability to connect legal professionals with peers and potential clients. Active participation on the platform helps law firms expand their networks and enhance visibility within the legal community. Many firms find that effective use of LinkedIn leads to new opportunities and professional growth.

How To Use LinkedIn as a Lawyer Ethically

When it comes to social media, the American Bar Association (ABA) has laid out clear guidelines that every lawyer needs to follow,

First off, according to ABA Formal Opinion 18-480, confidentiality isn’t something you can set aside just because you’re online. Even if you’re talking about something that’s a matter of public record, you still need to be careful. The duty to protect client information is as strong on the internet as it is in your office.

Another point that often gets overlooked is how we handle hypothetical situations. Sure, they’re useful for illustrating a point, but be mindful that even vague details can sometimes be enough for someone to connect the dots and identify a client. It’s easy to forget how small the legal community can be.

Model Rule 1.7 is a big one — avoid anything online that could create a conflict of interest. Something as seemingly harmless as messaging a judge on LinkedIn could cause this to be an issue. It might not feel like a big deal, but it could easily be construed the wrong way, and that’s not a headache you want.

And of course, state bar associations have their own guidelines, and these can vary significantly. Make sure you’re up to speed on what’s required in your jurisdiction.

Why Should Professionals Use LinkedIn for Their Law Firm?

LinkedIn can play a significant role in enhancing your law firm’s visibility and connections within the legal community. Here’s why it’s worth considering:

1. Showcasing Your Expertise

LinkedIn provides a platform to share your legal knowledge. Posting insights, case studies, and updates positions your firm as a trusted source in your practice area. When others see your contributions, it keeps your firm top of mind for future legal needs.

2. Attracting the Right Talent

Expanding your team becomes more effective with LinkedIn. Highlighting your firm’s culture, values, and accomplishments draws professionals who align with your vision. It becomes easier to connect with candidates who could be a great fit when you can easily learn more about them via their LinkedIn profile.

3. Building Professional Relationships

Connecting with other legal professionals, potential referral partners, and industry influencers is another advantage of LinkedIn. These relationships can lead to speaking engagements, publications, and other opportunities that enhance your firm’s reputation.

4. Staying Informed on Industry Developments

LinkedIn is a valuable tool for keeping up with the latest trends and changes in the legal industry. Engaging with relevant groups and industry leaders helps maintain a current and engaging presence while ensuring that your firm stays updated.

5. Strengthening Client Confidence

A well-maintained LinkedIn profile reflects your firm’s professionalism and active involvement in the legal community. Potential clients gain trust and confidence in your services when they see your firm is knowledgeable and engaged.

How To Use LinkedIn for a Law Firm

1. Build a Complete and Professional Profile

Your LinkedIn profile should speak to who you are and what your firm stands for. Make it complete, but don’t drown in details — focus on what matters most. A sharp headline, a clear summary, and a list of your specialties and accomplishments go a long way. You want to give people a reason to trust you right from the start.

If you need a sample LinkedIn summary for lawyers to get started, use the template below and customize it to your needs:

“I am a [Your Practice Area] attorney with [X] years of experience in [Specific Legal Fields]. At [Your Firm Name], I focus on [Primary Services or Specialties], helping clients achieve [Outcome or Value You Provide]. I’m passionate about [Unique Aspect of Your Practice], and I pride myself on [Key Value or Approach]. My work has led to [Notable Achievement or Case Outcome], and I’m committed to [Your Mission or Professional Philosophy]. Let’s connect to discuss how I can assist with your legal needs.”

2. Share Content That Matters

Posting regularly helps keep you on people’s radar, but it’s not about quantity. Quality is what counts. Share insights, legal updates, or your take on recent developments. Make sure what you’re posting is useful, relevant, and reflective of your expertise. The goal is to position your firm as a go-to resource in your area of law.

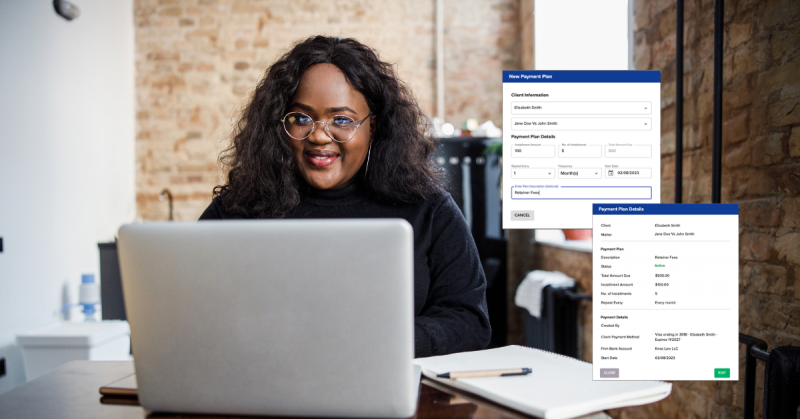

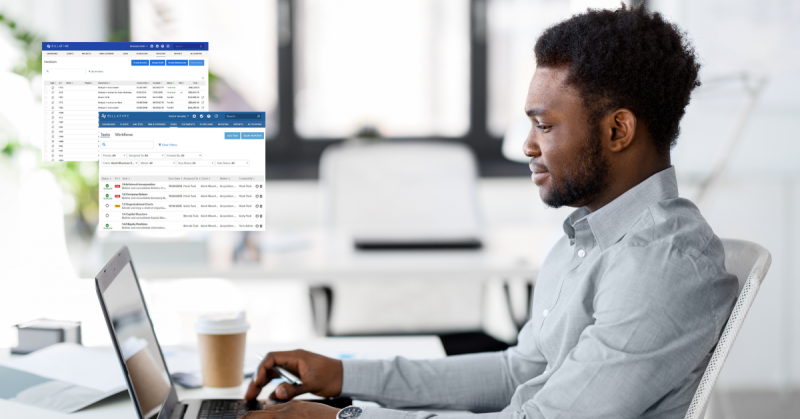

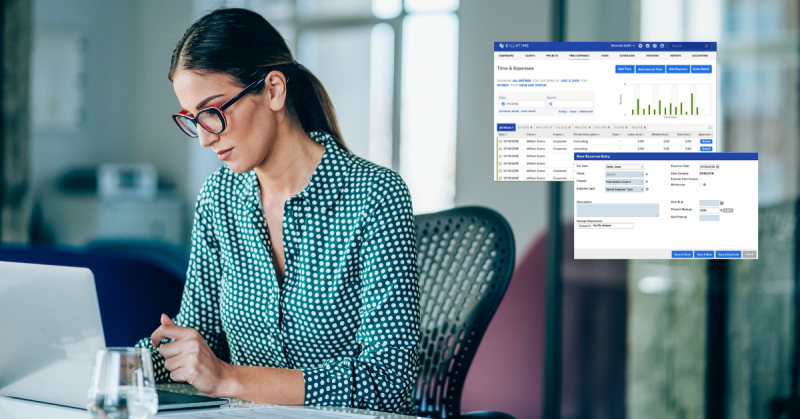

Pro Tip: Let Bill4Time’s task management features handle your social media workflow. Stay organized and on time, every time.

3. Get Involved in Conversations

Adding connections isn’t enough. Take the time to engage with what others are saying. Comment on posts, offer your perspective, and share content from your connections that resonates with you. Real connections come from real conversations, so don’t hesitate to jump in when something catches your eye.

4. Check Out LinkedIn Groups

Join LinkedIn groups that align with your practice or interests, and be active in them. Whether it’s sharing your knowledge or learning from others, participating in groups can lead to valuable relationships and insights. It’s a way to stay connected with the pulse of your field.

5. Use LinkedIn to Know Who You’re Dealing With

Researching potential clients, partners, or even opposing counsel on LinkedIn can give you a leg up. Understanding their background, interests, and connections can provide valuable context that you might not get elsewhere. Knowledge is power, especially when it comes to business development or case preparation.

6. Keep an Eye on What Works

Review your LinkedIn activity regularly. Notice which posts get traction and which ones don’t. Adjust your strategy based on what resonates with your audience. LinkedIn’s analytics can help you understand who’s engaging with your content, allowing you to refine your approach and keep things moving in the right direction.

Strengthening Your Law Firm LinkedIn Strategy With Bill4Time

You’ve put together a solid LinkedIn strategy, and now it’s time to keep it running smoothly. Managing content, staying engaged, and keeping up with industry trends can quickly become overwhelming without the right support.

Bill4Time can help simplify the process. Its task management features make it easy to plan and execute your social media schedule, ensuring you stay organized and consistent. Bill4Time can also help you manage your entire practice, from keeping track of clients and billing to handling all the day-to-day tasks that come with running a law firm. It’s a comprehensive tool that supports every aspect of your work, so you can focus on growing your practice.

If you’re ready to simplify your workflow and see how Bill4Time can support your firm’s success, consider trying out a demo.

If you’re ready to simplify your workflow and see how Bill4Time can support your firm’s success, consider trying out a demo. Discover how it can help you stay organized, from social media management to client tracking and beyond.

If you’re ready to simplify your workflow and see how Bill4Time can support your firm’s success, consider trying out a demo. Discover how it can help you stay organized, from social media management to client tracking and beyond.