Nothing is more frustrating than realizing a client doesn’t intend to pay you after hours of hard legal work. What starts as a great relationship devolves into a petty dispute over money. Sometimes the amount is trivial, but the issue—left unresolved—can be big, tarnishing an otherwise professional relationship, even your sterling reputation.

Nothing is more frustrating than realizing a client doesn’t intend to pay you after hours of hard legal work. What starts as a great relationship devolves into a petty dispute over money. Sometimes the amount is trivial, but the issue—left unresolved—can be big, tarnishing an otherwise professional relationship, even your sterling reputation.

Controlling client expectations is an art form: a nonstop balancing act of keeping clients and managing partners happy. It is something that is learned from experience, not in a law school classroom.

But seasoned attorneys counsel that prevention is worth far more than diplomacy. The best advice: Understand the root cause of client billing disputes, and then develop proactive strategies and procedures to avoid them in the first place.

Q: Why Don’t Sharks Attack Lawyers?*

*A: Professional courtesy.

At the heart of most “bad lawyer” jokes is a sad fact: Some clients are convinced that lawyers are less about truth and justice than they are about collecting exorbitant fees.

Great attorneys demonstrate excellence, not just with the law but even by the way they bill. Many experts recommend blending transparency, timeliness, and common sense when creating invoices to improve your chances of getting paid and retaining clients.

In an article in the July 2011 GPSolo eReport, Todd Scott, Vice President of Risk Management at Minnesota Lawyers Mutual, says that “the key to successfully recovering the firm’s net receivables is to take certain steps up front, at the start of the attorney-client relationship.”

First Things First: A Signed, Written Fee Agreement

Clients like to know exactly what they’re getting for their money, and that means you need to state as clearly as possible, in writing, your time-tracking and billing procedures before beginning any work on their case. If a dispute comes up later, you’ll have a written agreement that supports your case.

A written fee agreement—signed by you and your client—establishes the extent, and limits, of the attorney-client relationship, as well as the fee schedule. The agreement should state exactly the costs paid by the client. Clients are often astonished at the amount of out-of-pocket expenses incurred on their case. Identifying these costs (filing fees, expert witness fees, court costs, or photocopying charges) up front can prevent sticker shock when the invoice comes.

Having a signed fee agreement won’t mean much if your clients feel they’re facing unreasonable charges. Be sure to review ABA Model Rule of Professional Conduct 1.5: Fees when devising using your fee structure. It includes factors for local pricing standards, experience and skills of the attorney, the novelty and difficulty of the case, and how to determine whether the fee is fixed or contingent. For example, if your practice is relatively inexperienced, it’s unreasonable to charge the same hourly fees as a highly experienced and accomplished practice.

When quoting fees as a range, be realistic and competitive. But recognize that most clients “hear” the low end of the scale and ignore the high end. So, if the hours on a matter are heading beyond your original estimate, give a clear warning to the client. Don’t wait until after the fact, even if the causes of the overrun seem obvious. The client may not be happy (in the short run) but will appreciate your candor. Avoiding a surprise about fees demonstrates that you respect the client’s money and the professional relationship.

Here’s another good reason to be proactive: silence about work hours exceeding your original estimate is, to some, a tacit admission that the budget is on target. Some clients will argue that, despite the extra hours, they expected you to keep the original estimate because you gave them no warning.

This type of miscommunication and one-sided misunderstanding can lead to shorter client relationships.

The Goldilocks Strategy

Bills from attorneys can leave a client in the dark. Too much detail confuses clients and invites accusations of bill padding. Too little detail raises similar suspicions and may suggest a lack of internal controls or procedures. It is naive to expect the client to give your law firm the benefit of the doubt.

The correct approach is also a bit subjective: Provide sufficient details to explain tasks, but no more. Billing details should be used strategically to address a client’s unspoken questions:

- Why was this charge necessary?

- What was accomplished or how did this help my case?

Of course, attorneys should scrutinize invoices before sending them out to ensure that the bill reflects the accurate hours for the matter. But before you apply a stamp to the envelope (or press “send” in your e-mail), step back and try to observe if you applied common sense:

- Was the legal work handled by as few attorneys as possible, with a clear separation of work divisions to avoid overlap or duplication?

- Did your firm utilize the least expensive, most appropriate biller for each particular task?

- When billing large matters, does the description show a breakdown into subparts that are more easily understood?

Try to write descriptions without complex legalese. In fact, consider establishing parenthetical definitions of common legal terms in your software’s billing task descriptions. Clients should not be challenged to interpret an attorney bill or left trying to decipher abbreviations and acronyms.

When you perform a service without charging the client, be sure to put that task in the invoice with a $0.00 charge. The client may not appreciate your largess unless he or she knows about it! Just be careful to avoid giving away too much so clients don’t get too accustomed to the practice.

If you have a case that requires legal or nonlegal outsourcing, include similarly detailed descriptions. Clients may think that your use of third parties indicates your inability to provide adequate representation, so you may want to emphasize the reasons for seeking counsel or resources outside your own firm. And make sure you cover third-party resources and outside counsel in your written fee agreement.

Bill blocking, the practice of summarizing a list of tasks in a group for a certain amount of time, is a bad strategy. Many courts reject the practice because it makes attorney fee reimbursement difficult following a judgment. Instead, every time-tracking and billing invoice should reflect each independent task, itemized separately, with the time involved.

Submit Invoices on Time

Unfortunately, some clients consider a submitted invoice to be the start of a negotiation. To put your firm in the best possible position, get in the habit of promptly sending your invoice as soon as practical.

First, be sure you master your time-and-billing software so you can quickly scrutinize, edit, and then issue invoices without delay. Any capable time-and-billing software should have the ability to quickly adjust time entries and billing details to suit the reality of client relationships.

Prompt invoicing with sound descriptions sends a powerful signal to a client: We have a solid handle on the details of your case and the work performed. This demonstrates your administrative staff knows its job. It signals an air of invincibility and inevitability, making it somewhat less likely for a client to raise an objection.

Invoicing promptly also creates an impression of thoroughness for your firm. It’s another way to market your firm’s professionalism to your clients.

Think about the impression left with the opposite situation: a one-page invoice, with vague billing details, received months after a matter concludes. Clients get annoyed in this scenario and sense an opportunity to dispute charges. They perceive (unfairly or not) that your lack of timeliness indicates a lack of attention to detail or inaccuracy. It’s a chink in the armor that you should avoid.

When Clients Are Late, Be Direct

When a client is late paying your bill, it’s important to be clear and direct about your expectations. Many clients believe that lawyers are rich enough to weather a missed payment, so they will decide to pay other bills before they pay your firm. If this is a problem for your practice, let the client know directly that you expect payment from them according to your accurate time tracking and billing.

Unfortunately, your firm may not be able to avoid losing a client if you’re convinced that they won’t pay. Jay Foonberg, a best-selling author for the ABA, says, “If you’re going to get burned, get burned cheap.” If you have new clients who are missing payments but requires a lot more work on their case, make sure you’re confident that they will eventually pay before proceeding with their case.

Tips for Flat-Fee Arrangements

Flat-fee arrangements are becoming more common with law practices, but smart attorneys avoid verbal flat-fee agreements, which almost always lead to confusion and disappointment.

If you plan to charge a flat fee, write out the work your firm plans to do in clear language and make sure you fulfill those obligations. Clients are sensitive to excessive charges and padding, so avoid details such as:

- specific time amounts to complete tasks;

- staffing levels, especially the type and duration of resources; and

- non-refundable, up-front fees.

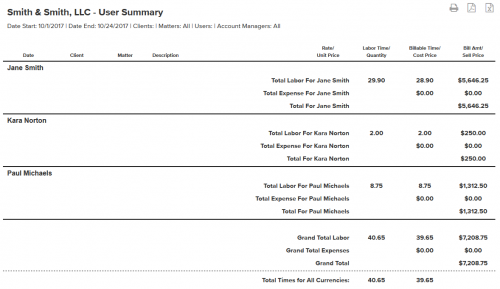

Although legal time-and-billing software is designed primarily for hourly billing, it can also be useful in flat-fee billing situations. For example, most flat-fee arrangements have a well-established hourly labor component. When you track your time based on matter type using time-and-billing software, you can identify tasks that would make good candidates for a flat-fee service. Once you establish an internal benchmark for your hours, you can use your time-and-billing software to confirm your actual hours versus the hours “budget” implied by the flat fee. This helps maintain your firm’s overall profitability for flat-fee matters.

Conclusion

Attorneys can eliminate many fee disputes by practicing the above strategies. Not only are properly prepared invoices using quality law firm billing software great communication tools, they inspire confidence and loyalty.

A previous version of this article appeared in the

Bill4Time is humbled and honored that it’s time tracking and billing software has been ranked a Time & Expense Tracking software category leader by users on GetApp, the most trusted review site for business software. GetApp’s Category Leader rankings highlight the top 25 cloud-based business applications for every essential business operation, including timekeeping and billing. The ranking uses five unique data points to assess apps, giving software buyers a shortlist of some of the top cloud-based solutions for their growing business.

Bill4Time is humbled and honored that it’s time tracking and billing software has been ranked a Time & Expense Tracking software category leader by users on GetApp, the most trusted review site for business software. GetApp’s Category Leader rankings highlight the top 25 cloud-based business applications for every essential business operation, including timekeeping and billing. The ranking uses five unique data points to assess apps, giving software buyers a shortlist of some of the top cloud-based solutions for their growing business.

The Bill4Time product team releases new and enhanced features, system improvements, and bug fixes several times per week. Organized by month, the Release Notes blog series will highlight all the changes we’ve implemented, so you can easily stay up-to-date on what’s new. If you have a question, feedback, or an idea – please leave a comment below!

The Bill4Time product team releases new and enhanced features, system improvements, and bug fixes several times per week. Organized by month, the Release Notes blog series will highlight all the changes we’ve implemented, so you can easily stay up-to-date on what’s new. If you have a question, feedback, or an idea – please leave a comment below! 1. Payment Method Options

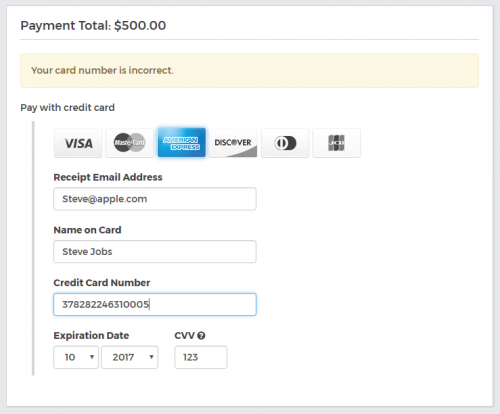

1. Payment Method Options Typos happen. Assume your clients will make a mistake when entering their payment details – maybe the expiration date of their card is formatted incorrectly or maybe the card number is invalid. In any event, your online payments gateway needs to clearly convey the error in a way that allows folks to resolve the issue and complete their transaction. The Bill4Time Client Portal is setup so that if a typo is made, the page will alert the customer to the specific fields that need to be updated – without clearing out the form and forcing your customer to completely re-enter all their payment details again. To go a step further, the Bill4Time Client Portal can store the payment details your clients submit so that when they go to pay their next invoice – they don’t have to reenter these details or even reach for their wallets!

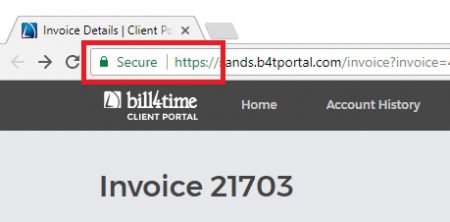

Typos happen. Assume your clients will make a mistake when entering their payment details – maybe the expiration date of their card is formatted incorrectly or maybe the card number is invalid. In any event, your online payments gateway needs to clearly convey the error in a way that allows folks to resolve the issue and complete their transaction. The Bill4Time Client Portal is setup so that if a typo is made, the page will alert the customer to the specific fields that need to be updated – without clearing out the form and forcing your customer to completely re-enter all their payment details again. To go a step further, the Bill4Time Client Portal can store the payment details your clients submit so that when they go to pay their next invoice – they don’t have to reenter these details or even reach for their wallets! Your customer doesn’t want to fill out lots of information within the online payment portal, and the last thing you want is for them to feel overwhelmed or frustrated – and abandon the transaction altogether. The key here is to keep it simple and only present those data fields which are required in order to complete the transaction. In addition to a bare-essentials payment entry form, you want to reassure your customers that you take their

Your customer doesn’t want to fill out lots of information within the online payment portal, and the last thing you want is for them to feel overwhelmed or frustrated – and abandon the transaction altogether. The key here is to keep it simple and only present those data fields which are required in order to complete the transaction. In addition to a bare-essentials payment entry form, you want to reassure your customers that you take their