Performance-based vs. salary: What’s the best compensation plan for law firms?

12/11/2019 By Bill4Time Staff

- Hazard #1: Emphasizing Revenue over profits

- Hazard #2: Prioritizing Billables over Realization

- Hazard #3: Focusing on Rainmaking instead of Service

- Hazard #4: Incentivizing personal success over firm success

- Hazard #5: Sacrificing health for financial rewards

- The best compensation plan for your firm is…

Is it the end of the pay raise?

According to SHRM, more and more companies are rethinking the annual pay raise. The rationale goes like this.

“If you wait an entire year [to review compensation], you might lose employees who don’t want to wait for a [raise].”

This seems true, doesn’t it?

It seems as if the traditional compensation systems are failing to produce the kind of loyalty and morale boost firms need to remain competitive.

Why the traditional compensation system is broken

The system creates team misalignment.

If they want a meaningful raise, employees will need to perform well throughout the year and during their annual performance review. During the review, employees sit down with firm leadership to discuss their performance and discuss the possibility of a raise.

Where’s the misalignment?

For many organizations, the annual performance review is simply a way for employers to justify paying their employees less than they deserve, at least from your employee’s perspective. Their perspective matters because it has a significant impact on your organization.

The annual review (and the compensation adjustments that follow) impact:

- Morale in your firm. If paralegals, associates or partners work hard, but their contributions are ignored (or worse, criticized), it kills morale in the company.

- Employee engagement or disengagement. Annual reviews (along with day-to-day interactions) can change your employee’s engagement levels completely. The severity of the annual review or your employee’s perception of the review is all it takes.

- Interest in advancement. An employee’s annual review or compensation plan may impact their interest or desire to climb the ranks at your firm. Instead of pursuing a career, they view their position with you as simply a job, a stepping stone to something better. If this happens, you won’t get their best work.

- Loyalty. Employee loyalty is a subset of engagement and dependent on how you treat them. If they’re fresh off an unjust performance review or they feel they’re receiving less than they deserve, they’re probably not feeling very loyal.

- Productivity. Gallup sorted employees into three engagement categories. The engaged (patriots) who love your firm and truly believe in the work they’re doing. Not engaged, employees who view work as “a job,” and the disengaged, active saboteurs who are looking for a way to punish your law firm for real or imagined slights. Each of these employees has varying degrees of productivity, the lower the engagement, the worse your team’s productivity.

- Utilization rates. Your utilization rate is a reflection of your firm’s productivity and billing efficiency. The higher your utilization rate, the more efficient your firm. Productivity measures individual performance, while utilization can be used to measure individual and group performance.

- Billable benchmarks: Unproductive employees won’t meet billable goals or timekeeping targets. This has a direct impact on the amount of revenue your firm brings in, and naturally leads to a decrease in realization rates.

- Realization rates. The amount of money you bring in is typically less than it should be. Unhappy, disloyal, disengaged and unproductive employees cost more and produce much less. It sounds obvious, but you’d be surprised at the number of firms that ignore this truth.

This isn’t even everything.

Firms are struggling due to lockstep compensation. Law firm employees are expensive, especially if they fail to hit their billable or performance targets. But these compensation models are wreaking havoc on firms even when employees exceed performance expectations.

Law firm compensation depends on environment

If your compensation model is a seed, your environment is the soil your compensation model needs to grow. A toxic environment creates a scenario where your compensation model, even a perfect one, is unlikely to thrive.

The following five toxic work environment hazards will negatively impact your compensation models.

Hazard #1: Emphasizing Revenue over profits

Look at your last three years of revenues. Have profits grown in lockstep with your revenues? If the answer is Yes, you’re in fantastic shape.

What if the answer is No?

Your law firm is in a dangerous position. If revenues exceed profits, you’re vulnerable. Any downturn, client poaching, or major economic change can bring your firm to its knees financially. When revenues exceed profits (due to partner decision making, poor margins to win client business, etc.), your firm has no buffer in place.

This may mean client work ends up costing you in the long run.

This also has a throttling effect on compensation in your firm. The perfect compensation model doesn’t matter all that much if you can’t follow through on your promises to your employees.

Hazard #2: Prioritizing Billables over Realization

It’s common for firms to focus on billables.

This makes sense.

Research from Thomson Reuters Legal Executive Institute and the Center for the Study of the Legal Profession (CSLP) at the Georgetown University Law Center had this to say about billables.

The average attorney is billing 165 fewer hours than the previous decade.

It’s no surprise then that firms prefer to focus on billables. The decrease in productivity, billables and utilization has a significant impact on the revenue a firm brings in.

Here’s the problem.

Your realization rates are just as (if not more) important as your billables. That’s because realization rates are also decreasing. James D. Cotterman, Principal with Altman Weil, outlines the problem.

“There are three metrics that makeup timekeeper revenue—demand, pricing, and realization. The recession ravaged all three of these metrics. Demand for lawyers’ services collapsed in some practice areas and weakened elsewhere. Rising hourly rates, once the driver of revenue growth with increases easily outstripping inflation and expense growth year over year, now barely match inflation. A decline in realization, which had been very gradual over the long-term, accelerated and, combined with slowing price increases, has resulted in nearly no net gain on a realized rate basis. Much of these patterns continue as the profession transitions beyond the recession.”

He outlines several realization issues.

- Timekeeper discounting. Inexperienced timekeepers may discount the amount of time entered on their timesheets due to the erroneous belief that “they took too long.” Other firms rely on reconstructive or sloppy timekeeping habits, resulting in fewer billable hours recorded than actually completed.

- Write-downs of unbilled time. According to Cotterman, realization rates suffer the most during billing. Attorneys are afraid clients will push back on their invoices or not pay them in full. These attorneys attempt to self-regulate using write-downs as a way to keep clients happy. This robs firms of much-needed revenue.

- Client adjustments resulting in write-offs. Aggressive or unexpected billing leads to distrust and increased client oversight, extending payment cycles and an additional loss in revenue.

These realization issues will decrease firm revenues and profits, hurting your firm’s ability to compete and compensate employees effectively.

Hazard #3: Focusing on Rainmaking instead of Service

Rainmaker worship.

It’s the prevailing culture at many firms. If an associate or partner can generate a significant amount of business for a firm consistently, they’re rewarded handsomely. They’re deified and treated differently than other producers at their firm.

And that’s the problem.

Origination credit, with no sunset clause, is common in many firms. But this approach creates unnecessary headaches. It also creates bitterness and resentment resulting in the breakdown of teams and the build-up of silos.

Here’s how it affects compensation.

It teaches producers in your firm to prioritize sales over service. The longer origination credit lasts, the worse this tendency becomes. Attorneys are motivated to land profitable clients but less interested in serving these clients.

It’s great, in the short term.

It’s intensely unprofitable in the long run. Billables aren’t where they should be. Inexperienced people spend more time on matters leading to client pushback. Permanent origination credit takes much-needed revenue from the firm, decreasing recurring revenue.

Don’t get me wrong. These attorneys should be rewarded handsomely for their hard work. But one-time performance shouldn’t provide perpetual and permanent rewards. These aren’t the only issues, but they reinforce my point.

Hazard #4: Incentivizing personal success over firm success

Some compensation models like the “eat what you kill” model are focused primarily on individual achievement. In this compensation model, the result is king. There’s no recognition whatsoever for anything beyond an individual attorney’s personal production.

This model creates mercenaries and increases disengagement towards your firm.

Think about it.

In this system, firms may charge attorneys a share of the overhead, but each partner pays the salaries of their support team. Attorneys also cover their individual expenses (e.g., business development, continuing education, personal technology, etc.).

These are all covered by the individual attorney/partner.

A junior attorney’s time is “purchased” from the firm at predetermined rates and billed to clients at a higher rate (whatever the attorney/partner feels is appropriate). Partners sell an interest in a particular file or client to another partner at a negotiated rate (e.g. 10 of whatever is billed by the purchasing partner).

Compensation models/plans like these are destructive.

Here’s an example of one problem.

Geoffrey has brought a new Fortune 500 client to the firm. He wants to keep the origination credit. His firm follows an “eat what you kill” compensation model, so Geoffrey is definitely against sharing is “kill” with the other partners and associates in his firm.

He decides to hoard his clients, matters and files.

As a result, Geoffrey performs work that he knows he’s not qualified to do. This has negative ramifications for his client, and it ultimately tarnishes his reputation, the firm’s reputation and future billings. At first glance, it seems his selfishness was to blame.

Geoffrey isn’t the problem.

The compensation model his firm decided to use is. These problems will weaken his firm’s ability to compete in the marketplace over time. It will also spawn competitors who open their own boutique shops, taking firm clients and secrets with them.

Hazard #5: Sacrificing health for financial rewards

Attorneys are often encouraged to sacrifice their personal health for financial rewards and professional achievement. It’s a great way to guarantee burnout in your team. In fact, there’s a simple formula to predict this.

Client trauma + essential minutia + mounting workload = burnout

The research bears this out.

- Stress, Burnout, Vicarious Trauma, and Other Emotional Realities in the Lawyer/Client Relationship: A Panel Discussion

- Do Not Make their Trauma Your Trauma: Coping with Burnout as a Family Law Attorney

- Vicarious Traumatization: The Corrosive Consequences of Law Practice for Criminal Justice and Family Law Practitioners

Lisa Johnstone is a famous example of overwork.

She’s the Skadden associate who died of an apparent heart attack at the ripe old age of 32 after pulling several 100-hour weeks. She felt compelled to take “stimulants” to help her perform under this mounting pressure. The pressure was so great that she was experiencing dramatic hair loss.

This is unsustainable.

It’s also completely backward. The research again is clear on this. According to MIT Sloan Senior Lecturer Bob Pozen, author of the bestselling book Extreme Productivity: Boost Your Results, Reduce Your Hours. Research by Tony Schwartz shows humans move from full focus to fatigue every 90 minutes.

Research shows productivity should be treated as a sprint.

That’s a problem.

Attorneys at firms are often expected to sprint through an entire marathon. They’re hit with more and more work. They’re forced to grind through a deluge of busywork, minutia and client matters.

It’s too much.

But it’s also what most compensation plans reward. Instead of rewarding team effort and collaborative KPIs, firms are forced into the miserable position of sacrificing their health and personal well-being for financial rewards.

These are all bad.

The best compensation plan for your firm is…

One that works with your firm identity rather than against it.

I’ve covered this in my [previous] [posts] on [compensation]. This isn’t a satisfactory answer though, is it?

What does the data say?

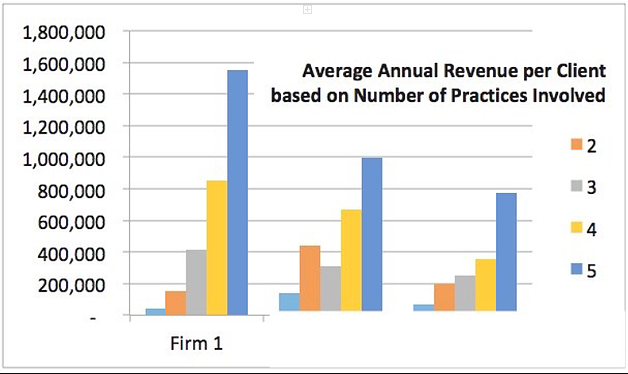

I’ve shared this before. Research shows, when clients were served by three practice groups, revenues were 5.7 times higher than those served by one. Clients who were served by five practice groups generated fees 17.6 times higher than those served by one.

This is a crucial point.

It’s also confirmed by a variety of sources, including data from Harvard Business School. Collaboration produces a significant amount of benefits. These benefits can extend to the individual, group and firm level.

Wait a minute.

Aren’t we discussing compensation plans? What does collaboration have to do with compensation plans?

It’s simple.

Collaboration provides the revenue needed to create the golden handcuffs.

Collaboration removes barriers.

- Many employees are self-interested mercenaries. Collaboration aligns their self-interest with the firm so everyone benefits.

- Partners want to receive the financial rewards that come with their role. Collaboration dramatically increases the payouts they are able to receive.

- Partners or associates often abscond with the firm’s clients, creating major financial upheaval. Collaboration, especially across practice groups, dramatically reduces “lift outs,” a group of partners or associates taking a large book of business away from their firm.

- Collaboration, if accepted by employees in the firm, builds deep trust in a way that’s impossible to copy. Firm collaborators grow to trust in their colleague’s competence (i.e., I trust you to do an exceptional job and avoid blunders) and integrity (i.e., I trust that you won’t undermine my relationship with my clients).

These are the barriers. What about the benefits?

- Employees are hesitant to leave their firms. Healthy firms with a supportive, collaborative culture provide employees with deep fulfillment they need to see that they’re making an impact and delivering value.

- Firm employees are also compensated well due to the considerable amount of revenue generated across practice groups. Firm leadership works to consistently reward their team based on shared KPIs.

- Employees are also hesitant to leave due to the consistent financial rewards. The harder they work, the more they receive. If they leave their firm, they’ll be forced to start at the bottom, if they receive a similar offer anywhere else.

- Partners make even more than they would by hoarding their book of business (or poaching origination credits from others). They make more money doing less work, which, if we’re honest, is what equity partnership was about in the past.

- The firm grows rapidly as clients receive extraordinary care, guidance and protection. The firm is aligned with their interests, and they’re receiving significant value. They’re open to spending more as a result.

- As word spreads, top tier employees jockey for the chance to join the firm. They’re burned out, exhausted and tired of the competitive backstabbing they’ve experienced professionally. Your firm gives them hope that a career in law could be profitable – personally and professionally.

So what does this mean then? Should your compensation plan be performance or salary based?

Both.

Why would firms use a salary + performance-based compensation plan?

The best compensation plan maximizes control for firms and employees

In my previous article on compensation, I mentioned that the vast majority of compensation models fall into one of seven basic categories. I’ll briefly recap them here.

- Equal partnership: Law firm profits are divided equally among a defined group of employees (partners, associates, support teams, etc.).

- Lock step: The longer an attorney stays with their firm, the more compensation (e.g., salary, bonuses) they’ll receive. This compensation model is all about seniority.

- Modified Hale and Dorr: Partners are split into three categories. In addition to a base salary, contributing parties would receive a predetermined percentage of the profits in exchange for the work that’s done.

- Simple Unit: The simple unit model rewards seniority, production, rainmaking and nonbillable work. It relies on a points system. This is used to determine profit allocation among partners and employees.

- 50/50 Subjective-Objective: In this model, metrics are used to determine attorney/partner income. The better the performance with KPIs (e.g., billables, realization, utilization, etc.), the more they make.

- Team Building: Individual performance takes a back seat to firm performance. Fifty percent of a partner’s income is based on the firm’s financial health and performance. Forty percent is based on a practice group or department’s performance. Ten percent would be based on individual performance.

- Eat What You Kill: The eat-what-you-kill model focuses exclusively on individual effort. Firms may charge attorneys/partners a share of the overhead, but each partner pays the salaries of their support team. Attorneys also cover their individual expenses

Note: You can read this article for a comprehensive breakdown.

As you’ve probably noticed, some of these plans are performance-based while others are salary based. There are pros and cons to both, so this complicates the decision further.

Which plan is best?

All of them – provided that you have the right framework in place. Instead of recommending one compensation plan over another, a layered strategy may be best. Here’s a strategy you can use.

- Use collaboration is the foundation.

- Team building (or a variation of #6 above) as the primary compensation model.

- Finally, add any other plan as a secondary compensation model.

This is an a la carte approach.

It isn’t an easy approach, it’s a lot more work, and it requires thinking on the part of firm leadership rather than the copy and paste methods many firms are used to.

A plan like this requires a few separate ingredients.

- A layered compensation plan: See above

- Fixing team dysfunctions: According to Patrick Lencioni, there are five dysfunctions of a team. They are: An absence of trust, fear of conflict, lack of commitment, avoidance of accountability and inattention to results. These issues affect each of the other ingredients below. It’s a good idea to continually monitor and resolve each of these issues as they appear.

- Consistent team training: As I mentioned above, competence builds trust. It’s an essential element that’s needed to increase organic interpersonal collaboration. An easy way to do this is via team cross-training. Practice groups train each other, teaching them about their specialties, how to better serve their clients and how to make money.

- Collaboration checks and balances: There needs to be a system that regulates team collaboration. This doesn’t need to be complicated. It can be as simple as verifying that employees are behaving ethically, are competent and that employees have an anonymous and reliable system for reporting inappropriate behavior.

- Origination planning: Rainmaking is the holy grail for many firms. Good origination plans create rainmakers on a consistent basis. A solid origination plan also eliminates client and file hoarding, end arounds, turf wars and silos, matter bartering and poorly picked pitch teams. Our ultimate guide to origination planning walks you through the twists and turns of origination credit.

- Counteracting unhealthy silos: Unhealthy silos create turf wars. You’ll need to know how to destroy barriers that allow unhealthy competition to crop back into your firm. You’ll also need to know how to identify, non-engaged and disengaged employees as well as how to rehabilitate or remove these employees.

- Proven hiring methodologies: Methodologies like Topgrading enable you to attract the top 10 percent of talent in the industry with a 90 percent success rate, reducing the odds of attracting disengaged saboteurs or morale killers.

- Behavioral ethics and value alignment: How will you handle offenders? What if a partner poaches clients or origination credit from another employee? Do you have the systems and procedures in place to address the problem?

Each of these ingredients tackles a barrier that threatens your compensation plan. These ingredients are the details minders in your firm should be focused on.

Why is this the best compensation plan?

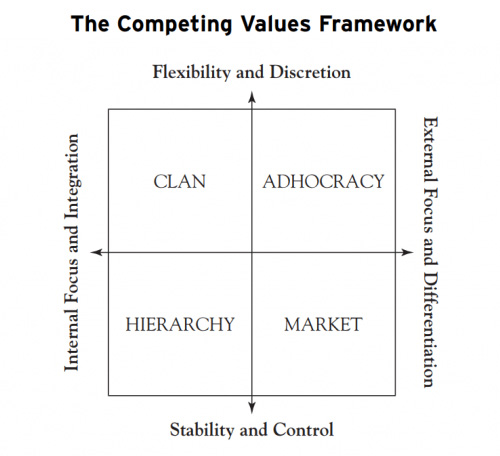

Because a layered compensation plan allows you to work with your firm’s culture rather than against it. If you’ve read my previous post on culture and values, you know why this is crucial.

So what does this look like?

If your firm has a clan culture where everyone behaves like family, You may prefer to:

- Use collaboration as the foundation.

- Use the team-building model (or a variation) as the layer for partners in your firm.

- Use a modified Hale and Dorr model for associates and support teams.

If your firm has a market culture that’s utilitarian, results-oriented and pragmatic, you may prefer to:

- Use collaboration as the foundation.

- Use the team-building model (or a variation) as the layer for partners in your firm.

- Use a kill-what-you-eat model to motivate associates and support teams to compete (in a healthy way) while also cooperating.

If you have an adhocracy culture you may prefer to:

- Use collaboration as the foundation.

- Use the team-building model (or a variation) as the layer for partners in your firm.

- Adjust compensation plans to fit your particular circumstance, whether that’s determined by practice groups, employees, etc.

If you have a hierarchy culture you may prefer to:

- Use collaboration as the foundation.

- Use the team-building model (or a variation) as the layer for partners in your firm.

- Provide a variation of the lockstep model for your firm.

See what I mean?

Why the “best compensation plan” question is difficult to answer

It depends on you and the identity of your firm.

Compensation, as we’ve seen, depends on a complex mix of ingredients. Traditional compensation systems are failing to produce the kind of loyalty and morale boost firms need to remain competitive.

We now know why.

Successful law firm compensation plans depend on environment. If your compensation model is a seed, your environment is the soil your compensation model needs to grow. A toxic environment creates a scenario where your compensation model, even a perfect one, is unlikely to thrive.

No one can decide for you.

You’ll have to choose. Use the framework I’ve shared today, and you’ll have the necessary ingredients you need to create the best compensation plans for your firm. Choose carefully, and you’ll find pay raises are largely irrelevant.