Like any business, law firms provide services with the expectation of being paid at the time the work is finished. Unfortunately, the average law firm only collects about 85% of invoiced amounts, which can add up to tens of thousands of dollars in lost revenue.

Collecting debts can be challenging, but it’s part of running a successful law firm. Instead of leaving billable hours on the table, learn how to set up a collections process for legal debts to keep your cash flow moving.

How Do Law Firm Collections Typically Work?

Law firm collections is a means of requesting clients pay for their outstanding invoice balance. Typically, this is done with a lawyer debt collection letter, also known as a demand letter of payment or a letter of demand.

A good law firm collections process can resolve client debts by encouraging your client to pay or opening the line of communication to find a resolution that works for your client and your firm. Then, if you have to take further legal action, the debt collection letter supports your case.

Why Do Law Firms Struggle with the Collections Process?

One of the mistakes law firms often make is considering the collection process only after the client receives the invoice. Instead, the relationship with the client — and the expectation to be compensated — should begin from the first interaction.

Clear, unambiguous language that establishes the fee agreement, what clients are getting for their money, and when they’re expected to pay sets the stage for fewer collections and more invoices paid on time. Also known as a legal billing policy.

In addition, detailed invoices that are easy for the client to understand also reduce collections. Some law firms send bills with just an amount due and vague descriptions of what a client is paying for, which can lead to disputes that delay payment.

7 Tips to Improve the Billing and Collection Process at Your Law Firm

Here’s how you can improve the collections process at your law firm:

1. Assess Your Firm’s Current Billing and Collections Process

Having the right systems in place is the first step to ensuring that clients have timely, clear, and accurate bills to pay your firm.

Assess your current billing and collection processes. Do you have a standardized process? Is there a fee agreement that’s clear to clients and well-defined guidelines for your billing policies? Do clients understand what they’re paying for, when they’re expected to pay, and what they’re getting in return?

If you haven’t already, be sure to create a legal billing policy that answers these questions and any other necessary billing items. You include invoicing timeframe, accept payment methods, late fee policies, and more.

2. Identify Areas for Improvement

Once you have an outline for your current billing and collections process, you can identify areas where you can improve.

For example, if you’re allowing each attorney at your firm to track hours in their own way, review bills individually, and send them out using mail or email as they choose, this could create opportunities for delays and errors that only make the collections process harder.

3. Create a Standardized Internal Collections Process

Start with a standardized internal collections process that includes time-tracking policies, standard invoicing policies, and a process for how hours are tracked and invoiced.

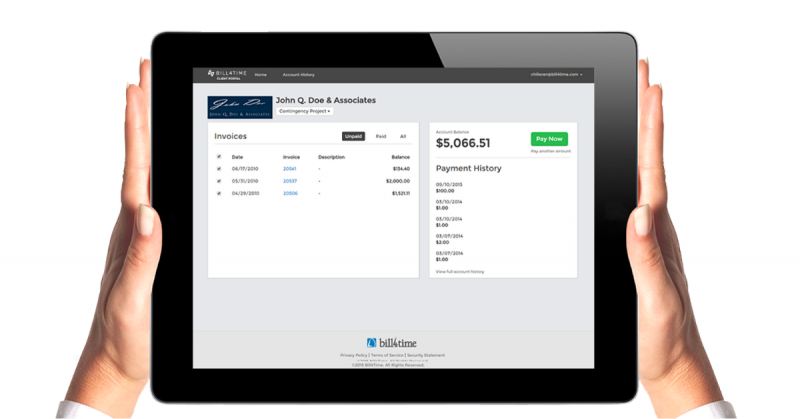

Up to 30% of billable time is lost because of poor timekeeping. With legal time tracking software like Bill4Time, you can quickly and accurately track your billable hours without sticky notes, notepads, or spreadsheets. Capture your time in real-time with detailed time blocks that illustrate what your client is paying for.

Bill4Time also standardizes the invoicing process with custom invoice templates that allow you to convert your billable hours to detailed, branded invoices you can send with just a few clicks.

4. Communicate Your Firm’s Billing Terms to Clients

Having a clear communication plan for your billing expectations should be part of the initial client intake process. With this plan, you should provide the scope of your work, billing timeline, payment options, fee arrangements, and the billing point of contact.

Draft this plan into a legal billing policy document, which you can store in Bill4Time so it’s accessible across your firm and easy to provide to clients.

5. Accept Multiple Payment Methods

One of the best ways to get clients to pay on time is by making it convenient for them to do so. Clients have come to expect the convenience of paying invoices online, even for their legal services, which you can offer with Bill4Time Payments.

The secure online payment portal processes transactions within Bill4Time, without third-party services or integration. You can reduce missed payments with customizable payment plans, such as weekly or monthly installments, with an eCheck, credit card, or debit card.

Bill4Time Payments has industry-low transaction fees and 100% compliance with IOLTA, ABA, and state bar guidelines, so you can offer convenience for your clients without it costing extra.

6. Send Reminders

As we mentioned before, simply sending an invoice isn’t enough. Proper follow-up will keep your firm and the client accountable for ensuring payments are completed on time. By setting up automated payment reminders, you can ensure that your clients know when they’re expected to pay. No more calling or emailing clients to remind them of their upcoming invoices or missed payments.

7. Track and Measure Your Collection Policy

Bill4Time has built-in expense reporting to track your invoice payment windows and keep tabs on client payment status. You can use these reports to track and measure your collection policy, identify areas for improvement, and get a look into your firm’s financial health.

Transform Your Law Firm’s Collections Process with Bill4Time

With Bill4Time, you can simplify every step of the billing and collections journey, from accurate time tracking to customizable invoices and convenient payment options for your clients. Instead of chasing payments, let Bill4Time handle the heavy lifting so you can focus on your clients.

Ready to take the stress out of collections and improve your cash flow? Schedule a demo today and see how Bill4Time can empower your firm to get paid faster and with less hassle.