Legal services are often seen as a necessity, but the cost can be a significant barrier for many clients. For law firms, this creates a dilemma: how to make legal help accessible without compromising on financial stability.

One solution gaining traction is the use of payment plans. Offering clients the flexibility to pay over time broadens access to your services and helps ensure a steady cash flow for your firm.

In this blog, we’ll explore how you can implement payment plans in your practice, making it easier for clients to afford your services while keeping your firm’s finances in check. Whether you’re a solo practitioner or part of a larger firm, this guide will help you navigate the ins and outs of setting up payment plans that work for both you and your clients.

Can I Offer Payment Plans as a Lawyer?

Yes, lawyers can offer payment plans, and it’s a practice that many firms have successfully adopted. The key is to structure these plans in a way that complies with legal and ethical standards while also protecting your firm’s financial interests.

While the American Bar Association Model Rules of Professional Conduct do not explicitly state that payment plans are permitted, they do require that any fees charged are reasonable and that the client fully understands the terms of the fee agreement, which would include payment plans. Additionally, the fiduciary duties outlined in various parts of the Model Rules, such as providing competent representation (Rule 1.1) and avoiding conflicts of interest (Rule 1.7), must be considered when structuring any payment arrangement.

How to Implement a Payment Plan at Your Law Firm

When considering payment plans for your clients, it’s important to strike a balance between accessibility and maintaining your firm’s financial stability. By carefully structuring these plans, you can provide flexible payment options that benefit both your clients and your practice.

1. Define Your Objectives

Start by determining what you want to achieve with your payment plans. Are you aiming to make your services more accessible to clients who may struggle with upfront costs? Or are you looking to maintain a consistent cash flow throughout the year? Clearly outlining your goals will help guide the structure of your payment plans.

2. Understand Your Clients’ Financial Situations

Before offering a payment plan, it’s crucial to have a candid conversation with your client about their financial circumstances. This conversation will help you tailor a plan that is both realistic for the client and sustainable for your firm. It’s important to assess whether a payment plan will truly benefit the client or if it might lead to further financial strain down the line.

3. Create a Payment Schedule

Once you’ve discussed your client’s financial situation, you can set up a payment schedule that works for both parties. Decide on the frequency of payments — monthly, bi-weekly, or another interval — and make sure the total amount due is clear from the outset. The schedule should be straightforward, with specific dates that both you and your client can easily track.

4. Assess Late Payment Terms

Being proactive about the possibility of late payments can save you time and prevent potential disputes down the line. Consider whether you’ll offer a grace period for late payments. A short period — perhaps five to ten days — gives clients a bit of breathing room without immediately triggering penalties. However, it’s important to clearly communicate the length of this grace period and what happens once it expires.

If payments are late beyond the grace period, you might decide to apply penalties or interest. These can take the form of a flat fee for each late payment or a percentage of the overdue amount. Clients who miss payments consistently may require further action. Possible steps include renegotiating the payment plan, requesting full payment of the remaining balance, or, in more severe cases, discontinuing services.

5. Draft a Clear Agreement

All payment plans should be documented in a formal agreement. This agreement should outline the payment schedule, any interest or fees, the methods of payment accepted, and the consequences of missed payments. Having a clear, written agreement protects both your firm and your client, and it sets the stage for a smooth billing process.

6. Communicate Regularly

Ongoing communication is vital. Regular check-ins, whether through email reminders or phone calls, can help prevent misunderstandings and keep payments on track. Clients are more likely to stick to their payment schedule if they feel supported and informed throughout the process.

By following these steps, you can find that balance where both parties benefit from the arrangement.

Benefits of Payment Plans for Lawyers

Integrating payment plans into your law practice offers a range of benefits that can positively impact both your client relationships and your firm’s financial stability.

1. Expanding Access to Legal Services

High upfront legal fees often prevent clients from seeking the help they need. By offering payment plans, you provide an alternative that makes your services accessible to clients who might otherwise be priced out. This approach opens the door to a broader client base while positioning your firm as one that prioritizes client needs and is willing to accommodate various financial situations.

2. Stabilizing Cash Flow

Legal work can be unpredictable, and so can the timing of payments. Payment plans create a more consistent and reliable income stream, smoothing out cash flow over time. Instead of waiting for large, one-time payments, your firm can count on regular, smaller installments that make financial forecasting easier. With Bill4Time Payments, you can automate these recurring payments, reducing the administrative burden and helping to keep your firm’s cash flow stable.

3. Building Stronger Client Relationships

Clients appreciate flexibility, particularly when it comes to managing their finances. Offering payment plans shows that your firm is sensitive to clients’ financial realities, which can build trust and foster long-term relationships. A client who feels supported is more likely to return for future legal services or refer others to your firm. Plus, Bill4Time’s automated payment reminders further enhance this relationship by ensuring clients stay on track with their payments, reducing the likelihood of misunderstandings or disputes.

4. Minimizing Time Spent on Collections

Time spent chasing down overdue payments is time taken away from practicing law. With structured payment plans, clients have a clear understanding of their payment obligations, and the regular cadence of payments reduces the likelihood of falling behind. When paired with Bill4Time’s automated reminder system, you can ensure that clients receive timely notifications about upcoming or overdue payments, making it less likely that you’ll have to engage in time-consuming collection efforts.

5. Gaining a Competitive Edge

In today’s legal market, clients have options, and many are looking for firms that offer flexible payment arrangements. By integrating payment plans into your billing strategy, you can attract clients who value this flexibility. It’s a simple way to differentiate your firm from others that may insist on large, upfront payments.

Keep Payment Plans on Track with Bill4Time

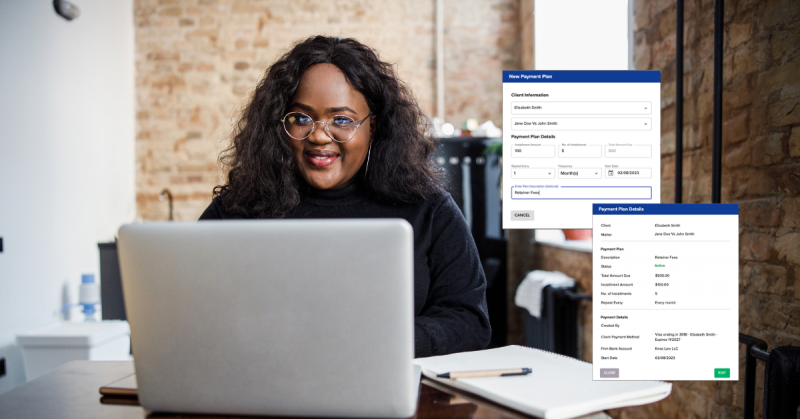

If you’re considering payment plans for your firm, Bill4Time offers a straightforward solution. With Bill4Time Payments, you can create custom, automated payment plans that align with your clients’ needs while keeping your billing process efficient.

You can also schedule recurring payments, set up automatic reminders, and handle online transactions — all in one place. No more juggling different systems or spending extra time tracking down payments. Bill4Time also provides built-in reporting tools, so you can monitor payment progress, keep an eye on cash flow, and generate detailed reports to manage your firm’s finances effectively.

To see how Bill4Time can work for your practice, try a free trial or schedule a demo today. Offering flexibility to your clients while maintaining control over your firm’s financial health has never been easier.