5 Affordable Bookkeeping Software Solutions for Law Firms

07/02/2018 By Bill4Time Staff

Whether you’re running a virtual law firm or a brick & mortar location, you need a bookkeeping software solution that can help you conduct the following:

- Better understand the amount of money coming in as well the expenses it takes to keep your firm going.

- Have your colleagues and associates access important information whenever their physically away from the office.

- Give accurate reports down to the last detail, accounting software is built to be accurate and reliable down to the last detail.

- Save time by generating statements, reports, and professional looking invoices instantly.

Now that you understand the benefits, here are some of the best performing bookkeeping software tools for law firms:

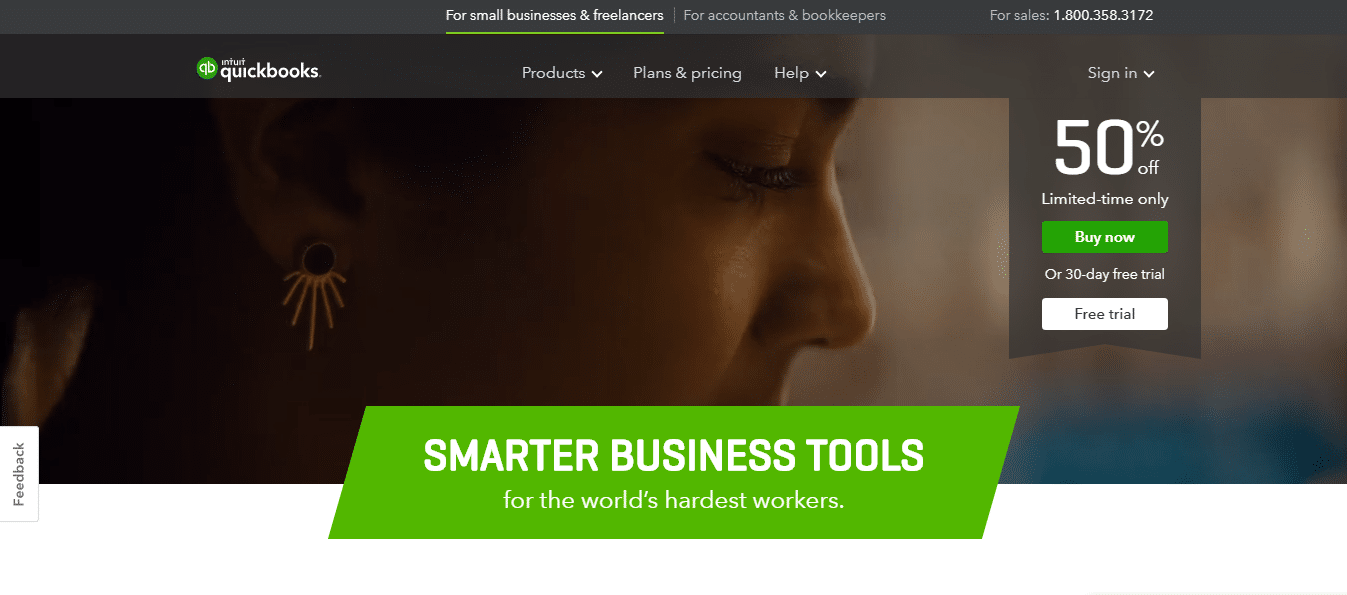

1. Quickbooks

Quickbooks is the leading accounting software for small businesses and gives you the ability to manage all of your finances with ease.

Capterra:

https://www.capterra.com/p/46497/QuickBooks/

G2 Crowd:

https://www.g2crowd.com/products/quickbooks-online/reviews

Features:

- Track bill status, record payments, and create recurring payments.

- Pay multiple vendors and bills at the same time.

- Create and send invoices from anywhere.

- Set up recurring bills so you never have to worry about missing a payment.

- Easily record & track bills you’ve paid by check or deposit.

Pricing

- Simple Start: $10 per month

- Essentials: $17 per month

- Plus: $30 per month

- Self-Employed: $5 per month

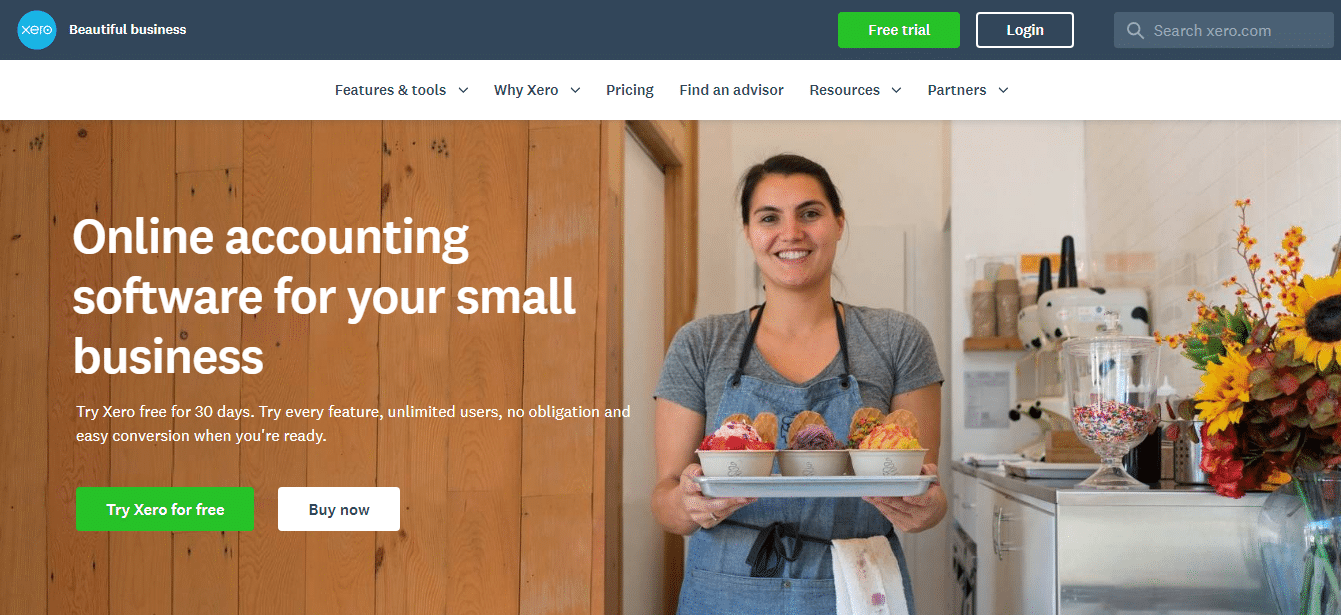

2. Xero

Xero provides accounting software with all the time-saving tools you need to grow your business. It’s secure, reliable, and provides you with 24/7 support for any issues.

Capterra:

https://www.capterra.com/p/169561/Xero/

G2 Crowd:

https://www.g2crowd.com/products/xero/reviews

Features:

- Create professionally made recurring invoices and receive updates whenever they’re opened.

- Import and categorize your latest banking, credit card, and PayPal transactions.

- Manage your business on the road with the Xero mobile app for iOS and Android.

- Calculate payroll, pay employees and manage payroll taxes.

- Accelerate your invoicing while tracking sales and purchases.

Pricing

- Starter: $9 per month

- Standard: $30 per month

- Premium 10: $70 per month

3. Freshbooks

Freshbooks accounting software makes running your small business easy, fast, and secure so you can spend less time on accounting and more time focusing on your work.

Capterra:

https://www.capterra.com/p/141824/Freshdesk/

G2 Crowd:

https://www.g2crowd.com/products/freshbooks/reviews

Features:

- Impress your clients with professional looking invoices that take only seconds to create.

- Organize and track your expenses easily so you’re aware of all of your spending habits.

- Able to accept credit cards so you can get paid even faster.

- Reports are easy to understand but powerful enough to let you know of any issues.

- Provides a mobile app so you’re always able to stay connected with your clients and take care of your accounting.

Pricing

- Lite: $15 per month

- Plus: $25 per month

- Premium: $50 per month

4. ZoHo

ZoHo helps you solve accounting challenges with the use of finance apps that take care of tasks like invoicing, expenses, subscriptions, etc.

Capterra:

https://www.capterra.com/p/110938/Zoho-People/

G2 Crowd:

https://www.g2crowd.com/products/zoho-reports/reviews

Features:

- Understand the ins and outs of your expenses and save money by understanding where you could spend less.

- Ability to connect to your bank account so you can get a real-time update on your cash flow.

- Use accounting reports like P&L, Balance Sheet, and cash flow statements to stay on top of your finances.

- Allows you to use inventory tracking to manage your supplies as they come in and go out.

Pricing

- Basic: $9 per month

- Standard: $19 per month

- Professional: $29 per month

5. Wave

Capterra:

https://www.capterra.com/p/124380/Payroll-by-Wave/

G2 Crowd:

https://www.g2crowd.com/products/wave/reviews

Features:

- Use receipt scanning and bank connections to track income and your expenses easily.

- Use direct deposit and online pay stubs to pay your team effortlessly and with guaranteed accuracy.

- Create and send professionally made invoices to your clients.

- Set-up automatic payments as well as payment reminders so you never have to worry about missing a payment again.

- Offers iOS and Android apps for sending invoices on the go.

Pricing

- Credit card processing: 2.9% + 30 cents

- Bank payment processing: 1% per transaction

- Payroll: $20 base fee + $4 per employee

Last Thoughts

Bookkeeping software provide a variety of benefits for legal practices over the traditional simple excel sheets and pen and paper solutions. They help with:

- Organizing your firm’s expenses

- Understanding how your firm is spending money

- Easing the process of sending professionally made invoices

When choosing a new software solutions, always make sure to do your own research on each brand to understand which would be the best fit for your firm. If you ever get stuck or need any recommendations on which bookkeeping platforms you should use, let us know!