How to Define Your Firm’s Legal Billing Guidelines

11/20/2024 By Allison Lemasters

Just like any business, establishing clear and ethically compliant billing practices is crucial for law firms. Your billing practices directly affect not only your bottom line but also your firm’s commitment to transparency and the client experience.

But creating your firm’s billing guidelines — and enforcing them — is a challenge of its own. Modern legal e-billing software simplifies the process by organizing your policies in one place, promoting consistency, and making fee collection more straightforward. And with the right approach (which we’ll go over below), your firm can establish billing practices that are easy to follow and beneficial for both your team and your clients.

The Role of Legal Billing Guidelines for Lawyers

Whether you’re drafting these policies for the first time or improving what you already have, thoughtful billing practices set the tone for how clients see your firm. Effective billing policies can:

- Help your team handle billing consistently and efficiently.

- Reduce errors that could lead to client dissatisfaction or complaints.

- Define roles so everyone knows who is responsible for each part of the billing process.

- Promote timely payments by minimizing client questions about charges.

- Directly affect your firm’s bottom line.

- Reduce the chances of malpractice claims.

When your client gets their bill, they see beyond the numbers and start forming opinions about your firm’s organization and honesty. Confusing charges or unexpected fees can leave them doubting your transparency or, worse, unwilling to pay.

Additionally, there are numerous ethical standards at play when it comes to legal billing. Attorneys must follow the American Bar Association’s (ABA) Model Rules of Professional Conduct, which highlight issues regarding transparency and fairness in fee arrangements. For instance, double billing—a practice where time is charged to multiple clients for overlapping tasks—is prohibited in many jurisdictions and can lead to serious repercussions, including disciplinary action or fee disputes.

Overall, when you view your billing practices as part of your broader client service strategy, you elevate your firm’s reputation while ensuring compliance with ethical standards.

What Should Be In the Billing Guidelines for My Law Firm?

Your legal billing guidelines help ensure that the client and everyone in your firm are on the same page about all things related to payment. Here is a sample of legal billing guidelines you can incorporate:

1. Assign Billing Responsibilities

Define roles clearly across your team. Who enters billable time? Who reviews invoices for accuracy? What are your outside counsel billing guidelines? Establishing responsibility for each step prevents duplication of work and minimizes mistakes. For instance, junior associates might handle initial time entries, while senior attorneys review and approve invoices before they’re finalized.

2. Set Standards for Legal Billing Descriptions

Include expectations for detailed descriptions that reflect the value of the work performed. Encourage your team to avoid vague entries like “client correspondence” and instead specify tasks such as “drafted response to client inquiry regarding settlement terms.” You can even include some legal billing entry examples for more common tasks that your team can copy and paste as needed.

3. Create Policies for Billing Increments

Define what billing time increments your firm should use, whether in six-minute, fifteen-minute, or other increments. Include rules for how to calculate attorney billable hours and rounding practices to ensure consistency across all timekeepers. For example, specify whether a four-minute task can be rounded up to six minutes (if using six-minute increments) and how that applies to short activities like emails or quick consultations. You can even include an attorney billing cheat sheet for quick reference on breaking down billing increments (check out this blog for some charts you can save and print for this purpose).

4. Streamline Expense Documentation

Provide clear instructions on how to record disbursements, like filing fees, travel costs, expert witness payments, etc. Standardize the documentation process so everyone uses the same codes, categories, or software tools. Encourage thorough documentation, as this helps ensure accurate reporting and smooth client invoicing.

5. Create a Review Process

Outline how and when your firm reviews invoices before they’re sent. Assign responsibility for checking time entries, verifying compliance with client engagement terms, and double checking disbursements are categorized correctly. A multi-layered review process, with at least one senior team member involved, minimizes the risk of errors or ethical oversights.

6. Incorporate Ethical Safeguards

Your guidelines should reflect the ethical obligations attorneys face in billing. Prohibit billing at attorney rates for tasks like scheduling or administrative duties. Include measures to avoid accidental double billing or overcharging for standard tasks. Regular internal audits can help catch inconsistencies and reinforce compliance.

7. Set Billing Timelines

Define deadlines for every step of the billing cycle. Require attorneys to submit time entries daily, or at least weekly, to prevent last-minute bottlenecks. Establish a consistent schedule for generating and approving invoices. Predictability benefits your internal workflow and client expectations alike.

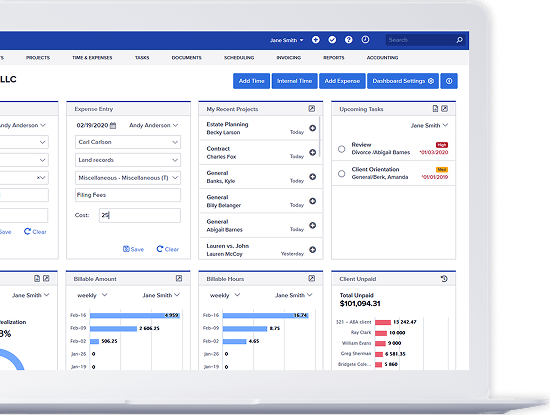

8. Include Legal E-Billing Software Protocols

Your internal billing guidelines should outline how your team uses legal e-billing software to support your billing practices. Specify which software your firm uses—for example, platforms like Bill4Time—and provide instructions on its key features, like time tracking, invoicing, and trust accounting. Include specific instructions on how to input data, such as tagging billable hours with clear descriptions or categorizing disbursements correctly. Bill4Time offers numerous training resources you can link to directly in your billing guidelines as well.

How to Communicate Your Legal Billing Practices to Clients

Billing guidelines can make it much easier to discuss billing issues with clients, as your team will have something to fall back on as questions arise. You can even include some pointers on communicating billing practices to clients, such as:

- Set expectations early. Discuss your billing process during the initial consultation or engagement agreement review. Cover topics like hourly rates, billing increments, and any costs the client may be responsible for, such as the filing fee or paying any third parties involved.

- Provide a written summary. Share a straightforward summary of your billing policies in the engagement letter or welcome materials. Use simple language to explain payment timelines, accepted payment methods, and where clients can access invoices.

- Make space for client questions. Let clients know whom to contact if they have questions about their invoices. If your team has the bandwidth, assign a specific team member to handle all inquiries.

- Address changes immediately. Notify clients as soon as there’s a change in the scope of work or cost expectations. Provide updates in writing to keep the communication clear and well-documented.

- Use technology for transparency. Bill4Time, for example, provides a client-facing portal where they can access invoices and track payment statuses. If you plan to use such features, include instructions on how to access them.

- Send regular payment reminders. Automate invoice reminders using your billing software to notify clients about upcoming due dates or overdue payments. Bill4Time’s automated payment reminders let you set customized schedules so clients receive timely notices while your team focuses on higher-priority tasks.

- Incorporate client feedback. Act on feedback from clients regarding your billing process. Adjusting how you communicate based on their input helps build stronger relationships and ensures your practices remain client-friendly.

How Legal Software Can Support Your Firm’s Billing Guidelines

Billing software transforms your firm’s guidelines from policies into practical workflows that your team can follow every day. These tools help your firm handle key tasks like tracking billable hours, creating accurate invoices, and collecting payments, all while staying consistent with your established practices.

For example, platforms like Bill4Time make it easy to automate routine processes, such as setting payment deadlines or sending reminders. Bill4Time’s client-facing features, like branded invoices and payment portals, also promote transparency and help clients stay on top of their obligations. By reducing manual work and centralizing your billing practices, you create a system that benefits both your team and your clients.

Bringing your billing guidelines to life is simpler when you have the right tools in place. Try a free demo of Bill4Time today and see how it can optimize your billing process, improve client satisfaction, and help your team work more efficiently.